Move-Up Buyers Are Choosing New Construction

At some point, a house that once felt perfect just… doesn’t anymore.

Maybe you need more space.

Maybe working from home turned your dining room into a permanent office.

Maybe the layout just doesn’t match how you live now.

If your current house is starting to feel like it’s holding you back instead of supporting your life, it’s natural to think about making a move. But that brings up the next big question: once you sell, where do you go?

For a growing number of buyers, the answer is something brand new.

New Construction Is a More Popular Choice Lately

According to the National Association of Realtors (NAR), more people are buying new homes than they have in years. The latest annual data available shows 16% of homes purchased were newly built.

At first glance you may not see why that’s a big deal. But that’s actually the highest share of new home purchases in almost two decades.

Why More Buyers Are Choosing a Brand-New Construction

For many buyers, especially move-up buyers, new construction isn’t just about aesthetics. It’s about lifestyle, convenience, and peace of mind.

1. Everything Is Brand New

You’re not inheriting someone else’s projects. No wondering how old the roof is. No budgeting for a new HVAC right after move-in. No big surprises when the previous owners patch job fails. For move-up buyers who’ve been dumping money into updating their current house, that’s a win.

2. You Can Customize Before Move In

If you choose a home that’s still under construction, you could have the chance to pick the flooring, counters, cabinets, hardware, lighting, and so much more. That level of personalization can be a draw for move-up buyers like you, because it allows you to hand pick the fit and finishes you’ve been wanting for so long.

3. A Home Designed for How People Live Today

Most new construction homes are built to current building standards and buyer preferences, which means you could see built-in smart home features, better energy efficiency (which can lower utility bills), and even more modern floor plans and features. And if your layout just isn’t working for you anymore, you may find exactly what you need now in a new home.

4. Neighborhood Amenities

New developments often include shared community spaces like walking trails, parks, playgrounds, or even pools and gyms. For families and active households, that’s a big bonus to have that just a few steps out of their front door.

5. Builder Incentives

Not to mention, since there are more new homes on the market than the norm, builders are motivated to sell what they have. So, you may find they’re more willing to negotiate than you’d expect on things like price, upgrades, and more.

Bottom Line

If your current house isn’t meeting your needs anymore, don’t assume your only choice is an existing home. New construction is becoming a real contender, especially for move-up buyers who want space, features, and a home that works for how they live now.

Curious whether new construction might be a fit for you? Let’s chat.

Inventory Is Making a Comeback in 2026

After a long stretch where buyers were competing for too few homes, inventory has made a comeback over the past year. And depending on where you live, that’s opening up your options in a meaningful way.

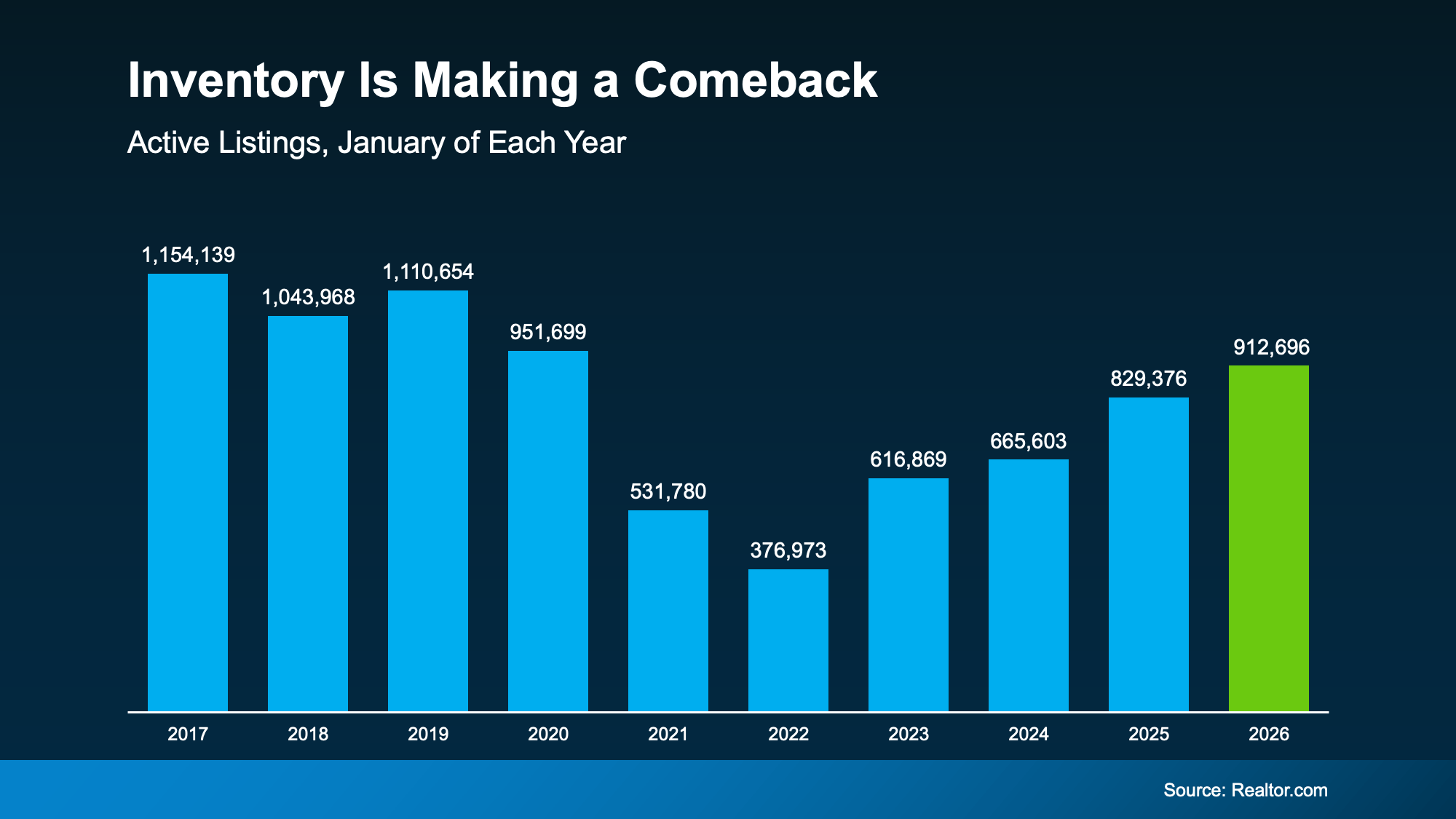

According to Realtor.com, the number of homes available for sale in January was the highest it’s been since 2020. Here’s why that’s such a big deal. Getting back to pre-pandemic levels signals a slow and steady return to what’s typical:

Now, it’s worth noting, nationally we’re not there yet – and having more inventory improving won’t suddenly “fix” the market. But the growth we’ve seen lately still changes how competitive the market feels.

Now, it’s worth noting, nationally we’re not there yet – and having more inventory improving won’t suddenly “fix” the market. But the growth we’ve seen lately still changes how competitive the market feels.

- When there are more homes for sale, buyers gain time, options, and leverage.

- When there aren’t, the pressure ramps up quickly.

In the years since 2020, there weren’t enough homes for sale, and that made the market feel different. Rushed. Stressful. Intimidating.

But now it’s finally getting better.

A Growing Portion of the Country Is Getting Back to Normal

Depending on where you live, inventory growth is going to vary. Some places are bouncing back faster than others. According to Lance Lambert, Co-Founder of ResiClub, in January 2025, just a little over one year ago, only 41 of the 200 largest metros were back to normal inventory-wise.

But around the end of year, almost half (90) of the largest 200 metro areas were back at or above typical levels. That’s a big improvement in roughly a year. And it’s not done yet.

Inventory Is Expected To Keep Growing

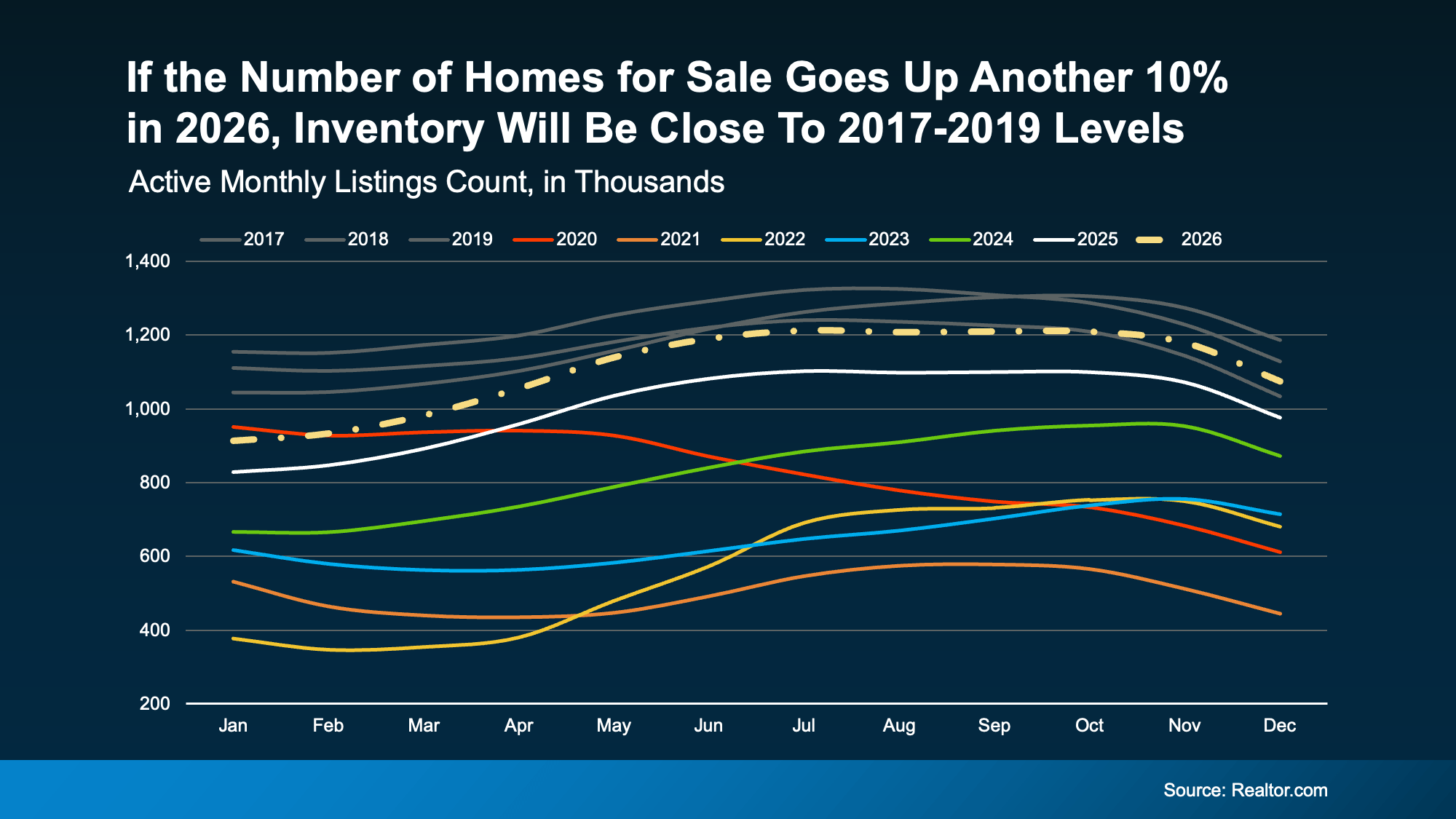

Looking ahead, forecasts suggest the number of homes for sale could rise another 10% this year, which means even more markets should join the list of places where supply has rebounded.

Here’s a graph that shows what an extra 10% would do for the market this year. You can see that projected growth (shown in the dotted line) hits inventory levels seen in 2017-2019 by roughly this fall (the gray lines). That means we may reach normal by end of year, nationally:

And that changes your home search in a good way. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, puts it:

“. . . housing market conditions are gradually rebalancing after several years of extreme seller advantage. Buyers are beginning to see more options and modest negotiating power as inventory improves . . .”

In other words, the market is starting to work with buyers again — not against them.

Bottom Line

Inventory isn’t fully back to normal everywhere. But it’s moving in the right direction. And, in some areas, it’s already there.

If you’ve been waiting for a moment when you have options and a little breathing room, this is the strongest setup buyers have seen in a long time.

If you want to know what’s happening in our local market, let’s talk.

Top 3 Reasons To Buy a Home Before Spring

If you’re planning to buy a home this year, you may be focused on the spring market. And hoping that when spring does hit, you’ll see:

- Mortgage rates drop a little more.

- More homes hit the market.

But here’s what most buyers don’t realize. Buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.

Here are three reasons why accelerating your timeline over the next few weeks could actually be a better play.

1. Holding Out for Lower Rates May Not Pay Off

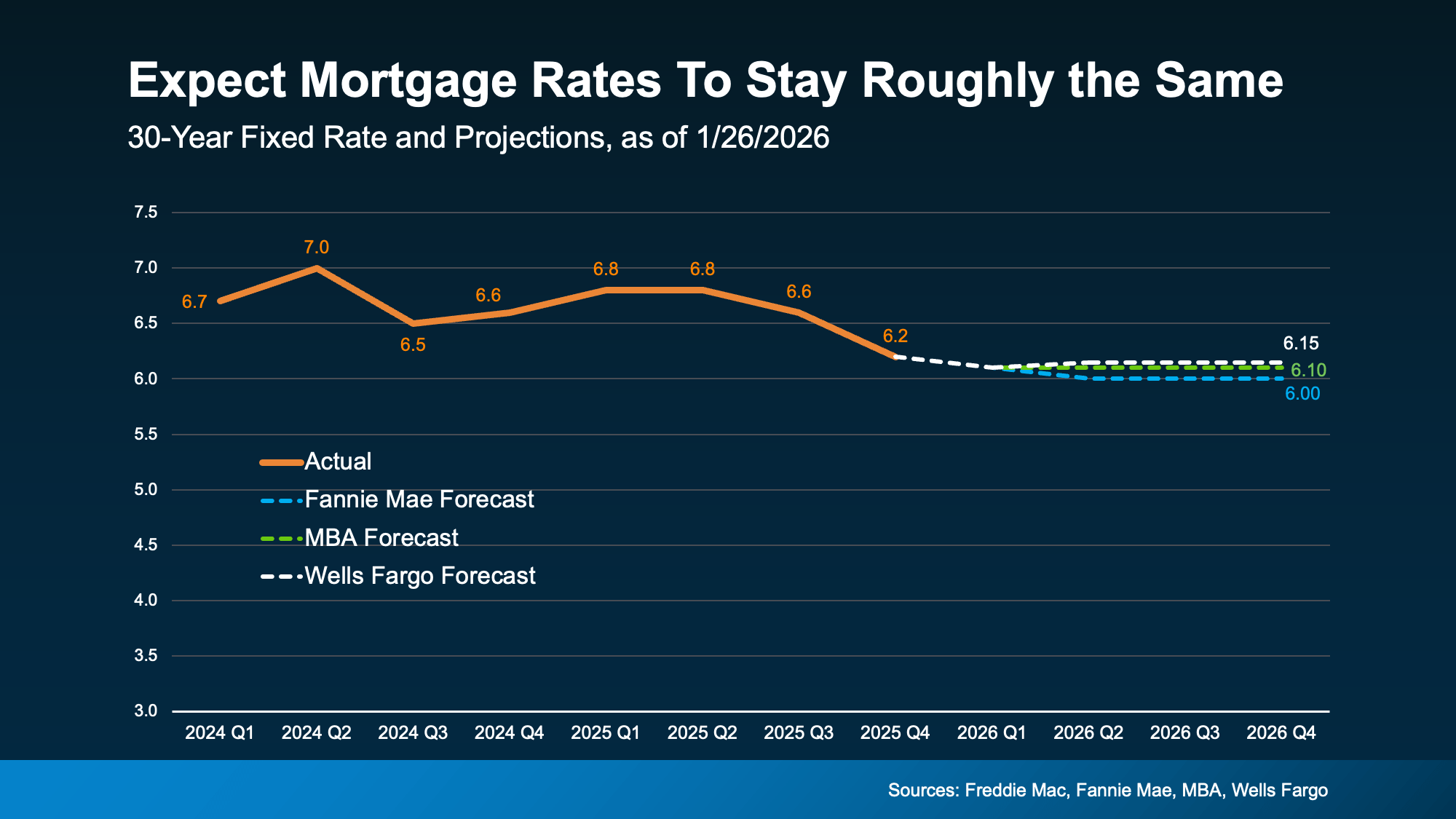

A lot of buyers are hoping mortgage rates will fall even further. But that’s not the best strategy. Here’s why. Experts are pretty aligned on this: rates are expected to stay roughly where they are.

Forecasts throughout the industry all point to the same thing: rates are projected to be in the low-6% range this year (see graph below):

That’s not a bad thing, especially if you consider how much rates have already come down. Over the past 12 months, they’ve dropped roughly a full percentage point. And for many buyers, that means affordability has already improved more than they may realize.

That’s not a bad thing, especially if you consider how much rates have already come down. Over the past 12 months, they’ve dropped roughly a full percentage point. And for many buyers, that means affordability has already improved more than they may realize.

So why wait a few more weeks just for more buyers to jump in and act as your competition? You already have a window right now. As Chen Zhao, Head of Economics Research at Redfin, explains:

“House hunters should know that this may be near the lowest mortgage rates fall for the foreseeable future.”

2. Spring Means More Competition + More Stress

Speaking of competition, the spring market is popular for a reason, but with popularity comes pressure. With more buyers active at that time of year, you’ll have to move faster once you find a home you like. And no one likes feeling rushed.

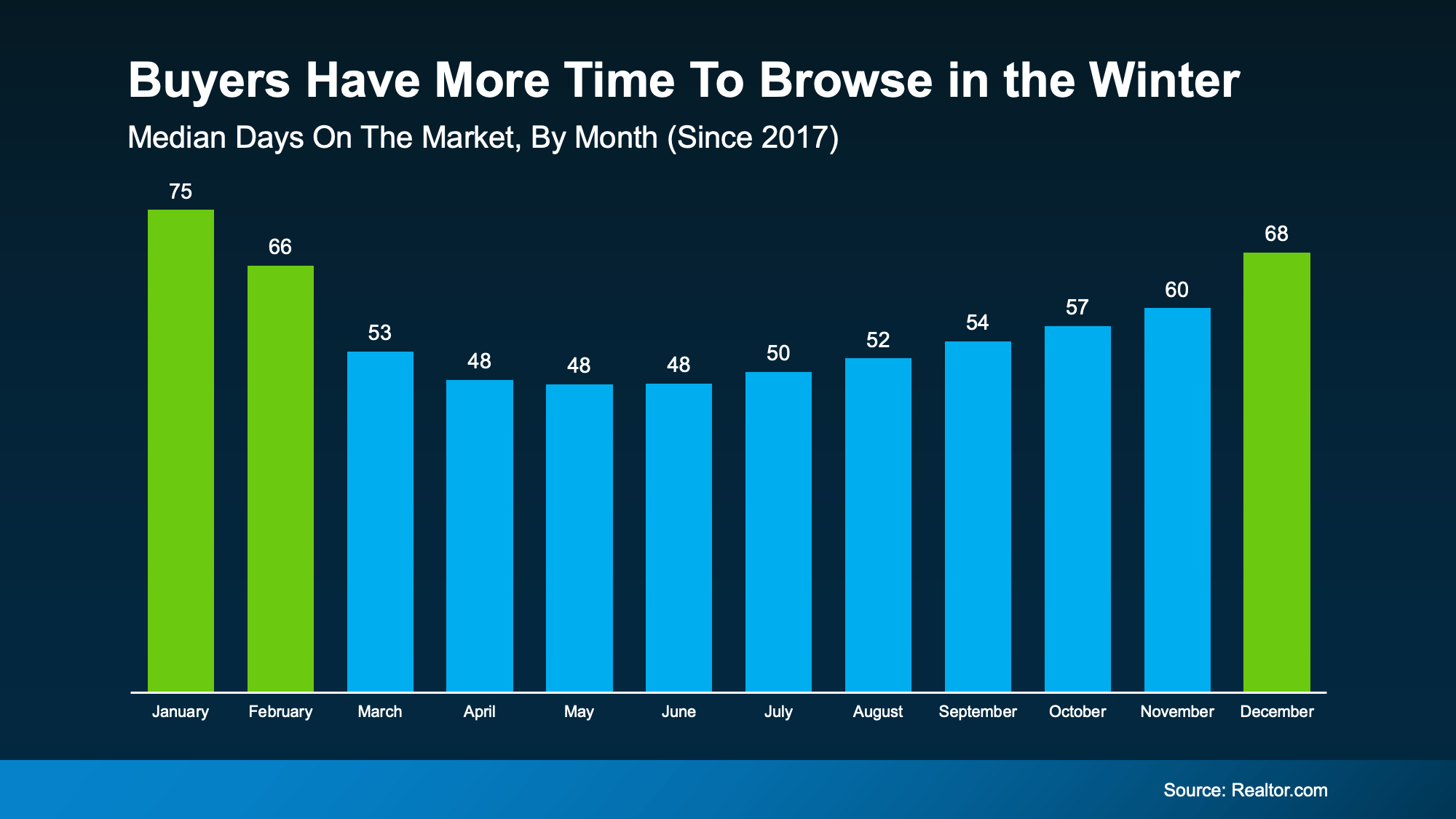

But buy now and you have more time to browse. Fewer people are looking, so homes sit longer.

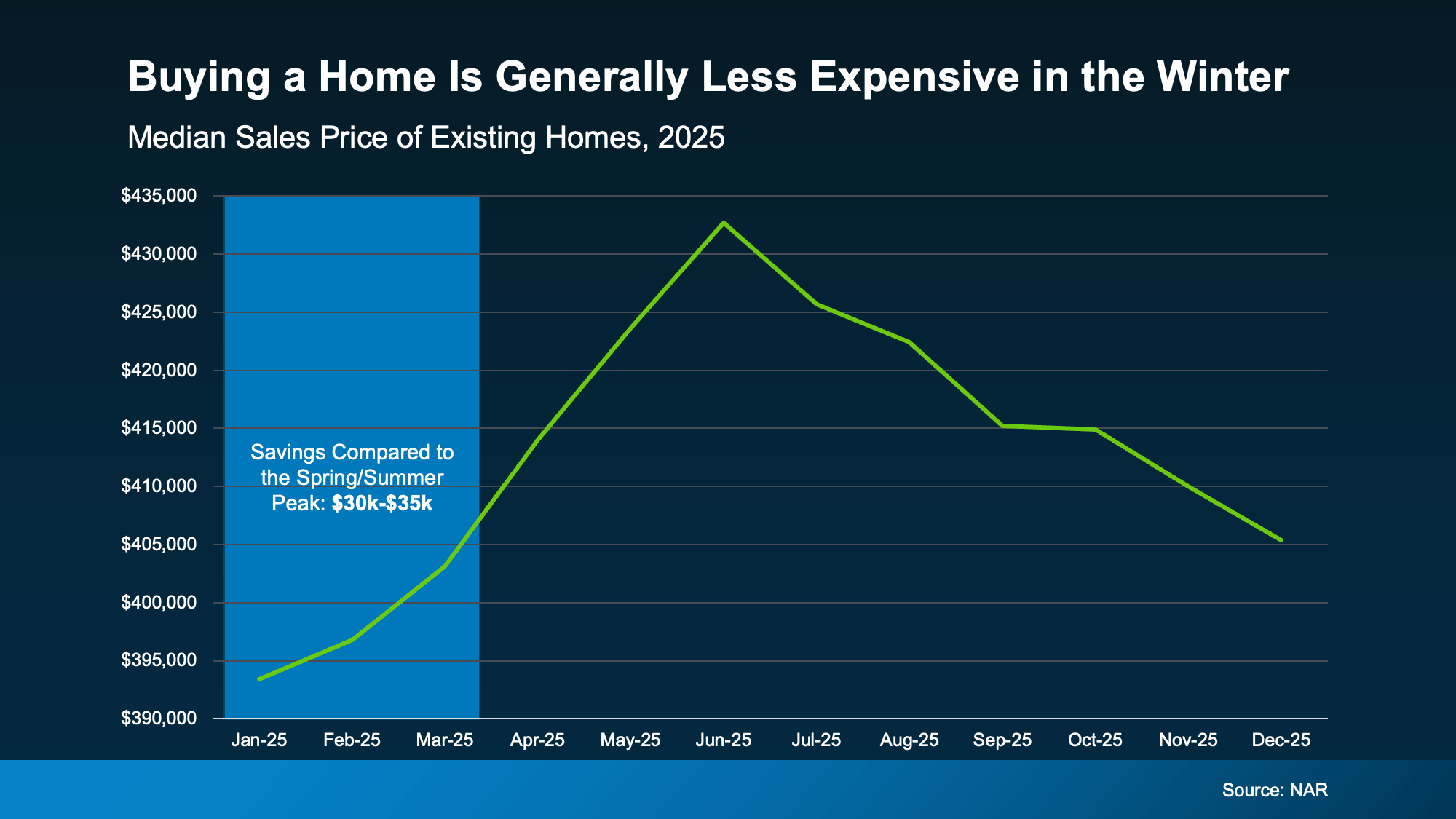

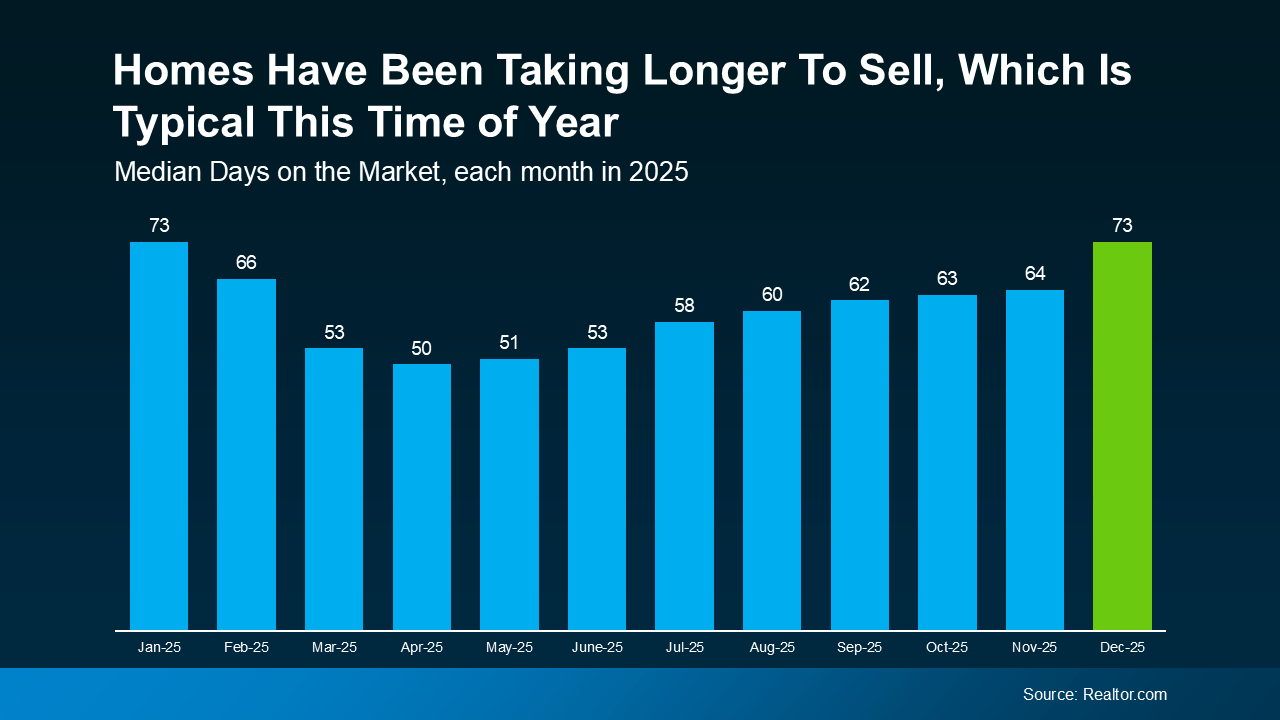

You can see this play out in the data from Realtor.com (see graph below). In winter months, it takes an average of about 70 days for a home to sell. In spring? That drops to about 50 days. That’s a 20-day swing – and that pace is going to be more stressful.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

3. Prices Tend To Rise When Competition Heats Up

And here’s something most buyers forget to factor in. Prices usually respond to demand. So, when demand is higher, prices are too. Bankrate explains:

“Spring and early summer are the busiest and most competitive time of year for the real estate market . . . home prices tend to be steeper to reflect the increased demand.”

In fact, data from the National Association of Realtors (NAR) shows that in 2025, buyers who purchased in the beginning of the year saved roughly $30,000–$35,000 compared to those who bought when prices peaked in the spring or early summer.

And let’s be honest, for a lot of buyers today, every little bit of savings helps. That’s why buying just a few weeks earlier, before prices ramp up, will be better for you and your wallet.

And let’s be honest, for a lot of buyers today, every little bit of savings helps. That’s why buying just a few weeks earlier, before prices ramp up, will be better for you and your wallet.

Bottom Line

Buying a few weeks before spring isn’t about rushing. It’s about choosing to be ahead of the curve and knowing you want more leverage, less stress, and meaningful savings.

If you’re ready and able to buy now and want to get the ball rolling, let’s connect.

You May Not Want To Skip Over That House That’s Been Sitting on the Market

When you see a house that’s been sitting on the market for a while, the reaction is almost automatic. You start thinking:

What’s wrong with it?

Why hasn’t anyone bought it yet?

Am I missing something?

That mindset made sense a few years ago. But in today’s market, you may actually miss out.

More Time on Market Isn’t Automatically a Concern Anymore

A few years ago, homes sold in just a matter of days. Sometimes, hours. Anything that lingered longer than that raised concerns. But that’s no longer the baseline.

Inventory has grown. Buyers have more choices. And homes are taking longer to sell across the board. Those are some of the reasons why the typical time it takes a home to sell has climbed this year:

a graph of blue barsAnd it’s not that 73 days is slow. That’s actually pretty normal for this time of year. It just feels slow because you heard so much about houses being snapped up in the buying frenzy a few years ago.

That shift alone explains a lot of what you’re seeing. It’s not necessarily that there’s anything wrong with the house itself. Although, let’s be honest, sometimes that is the case.

Most of the time today, a house that’s taking longer to sell simply means:

There are a lot of homes for sale in that area

The seller priced a little too high at first

The home didn’t photograph as well online

Buyers passed it over for flashier listings nearby

The timing just wasn’t right when it first hit the market

None of those are necessarily deal-breakers.

What Buyers Often Get Wrong About These Listings

Because even though you may assume a house that hasn’t sold must have hidden issues, the reality is, that’s not always the case. And, if the house does have issues, it’ll show up quickly in your inspection.

That’s information you can use to negotiate. Not a reason to walk away automatically. And in many cases, that’s where buyers find the best deals.

The key is knowing which homes that have been sitting for a while are worth a second look – and which ones aren’t. That’s why working with a local agent makes a real difference. They’ll be able to look at disclosures and more to help you uncover hidden gems other buyers may overlook.

Bottom Line

A home sitting on the market isn’t always a warning sign. Sometimes it’s an overlooked opportunity.

If you want help identifying which homes are worth a second look (and which ones to skip), let’s talk.

Turning a House Into a Home: The Benefits You Can Actually Feel

There’s a lot of conversation about home prices, mortgage rates, and affordability right now – and those things are important. But if you’re thinking about buying a home, it’s worth remembering something the headlines rarely talk about: people don’t buy homes just for financial reasons. They buy them for their lives.

Because while homeownership can absolutely be a smart long-term financial move, it also comes with some emotional benefits spreadsheets just can’t capture. Maybe that’s why a 2025 survey from Fannie Mae notes:

“Consumers were twice as likely to mention lifestyle benefits (67%)—like security, customization, and outdoor space—than financial benefits (34%) when explaining why their homes have become more important in recent years.”

Here are a few reminders of what owning a home gives you that renting never will.

1. A Milestone You Get To Be Proud Of

Buying a home is a big deal. First home, fifth home – it doesn’t matter. It’s a moment you’ll remember. And when you finally get those keys and walk through the door, that feeling of “I did this” hits different. It’s not just a purchase. It’s an accomplishment.

2. A Place That Feels Like Your Reset Button

Life is busy. Having a place that’s truly yours where you can shut the door, take a breath, and settle into your own routine is something renters rarely talk about until they finally experience it. Home becomes the place you go to recharge, not just the place your mail is delivered.

3. Space That Fits the Way You Actually Live

Need a quiet corner for work calls? A backyard big enough for the dog that thinks it’s a person? A shorter drive to see the people who are most important to you? When you own, you get to choose a space that fits your life now and where it’s heading – and it just feels right.

4. Freedom To Make It 100% Yours

Want to paint the kitchen navy? Go for it. Thinking about a wall of floating shelves or a bold wallpaper moment? Do it. Need space for a home gym or a reading nook? Make it happen. Homeownership gives you the freedom to shape your space instead of asking for permission to change it.

Bottom Line

Buying a home isn’t only about dollars and data points – it’s about building a life you love.

So, if you’re thinking about a move in 2026, keep the emotional side in the conversation too. And when you’re ready to explore your options, let’s connect so you have a pro on your side to guide you through the process with clarity and confidence.

Not Sure If You’re Ready To Buy a Home? Ask Yourself These 5 Questions.

If you’re trying to decide if you’re ready to become a homeowner in the next twelve months, there’s probably a lot on your mind. You’re thinking about your finances, today’s mortgage rates, home prices, the current state of the economy, and more. And, you’re juggling how all of those things will impact the choice you’ll make. It’s a lot.

But here’s what you need to remember. While housing market conditions are definitely a factor in your decision, your own personal situation and your finances matter too. As an article from NerdWallet says:

“Housing market trends give important context. But whether this is a good time to buy a house also depends on your financial situation, life goals and readiness to become a homeowner.”

So, instead of trying to time the market, focus on what you can control. Here are a few questions that can give you clarity on whether or not you’re ready to make your move.

1. Do you have a stable job?

Buying a home is a big commitment. You’re going to take out a home loan stating you’ll pay that loan back. Knowing you have a reliable job and a steady stream of income is important and will give you peace of mind for a purchase so large.

2. Have you figured out what you can afford?

If you have a reliable paycheck coming in, the next thing to figure out is what you can afford. This depends on your budget, spending habits, debts, and more.

At this point, it helps to talk with a trusted lender. They’ll be able to tell you about the pre-approval process and what you’re qualified to borrow, current mortgage rates and your approximate monthly payment, closing costs, and other expenses you’ll want to budget for. That way, you have a good idea of what to expect.

3. Do you have an emergency fund?

As you crunch your numbers, you’ll want to make sure you have enough cash left over in case of emergency. Think about it. You don’t want to overextend on the house, and then not be able to weather a storm if one comes along. It’s not a fun topic, but it’s an important one. As CNET says:

“You’ll want to have a financial cushion that can cover several months of living expenses, including mortgage payments, in case of unforeseen circumstances, such as job loss or medical emergencies.”

4. How long do you plan to live there?

It was mentioned above, but buying a home comes with some upfront expenses. And while you’ll get that money back (and more) as you gain equity, that process takes some time. If you plan to move again soon, you may not recoup your full investment.

So, how long should you stay put in an ideal world? Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Five years is a good, comfortable mark. If the price of your home appreciates considerably, then even three years would be fine.”

So, think about your future. If you’re going to live there for a while, it may make sense to go for it. But, if you’re looking to sell and move within a year or two because you’re planning to transfer to a new city with that promotion you’ve been working so hard for, or you anticipate you’ll need to move to take care of family, those are things to factor in.

5. Do you have a team of real estate professionals in place?

If you do, great. But if you don’t, finding a trusted local agent and a lender is a good first step. Having the right team can make figuring out everything else easier. The pros can talk you through your options and help you decide if you’re ready to make your move, or if you have a few more things to get in order first.

Bottom Line

If you want to have a conversation about the most important things you need to consider when buying a home, let’s connect.

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Momentum is quietly building in the housing market. New data from NerdWallet shows more Americans are starting to think about buying a home again. Last year, 15% of respondents said they planned to buy a home in the next 12 months. This year, that number rose to 17%.

That 2% increase might not sound like a big jump, but in a market where buyer demand has been cooling for the past few years, it’s a sign things are starting to shift. More people are feeling ready (or at least closer to ready) to take the leap and buy a home in 2026.

And if you’re in that camp and buying a home is on your goal sheet this year, this is your nudge to connect with a local agent and a trusted lender to start laying the groundwork now.

Planning To Move in Early 2026? Start with These 4 Steps

If you’re eager to get the ball rolling right away, here’s what to tackle first:

- Get pre-approved. A pre-approval gives you a real understanding of your buying power and what your payment could be at today’s rates. But keep in mind, Experian says most pre-approvals are only good for 30-90 days, so this step makes the most sense as you’re ready to get serious.

- Run the numbers. Look closely at all your expenses to come up with your budget. Consider what you’re spending on other bills and what your monthly mortgage payment would be once you buy. That way you go in with open eyes and you don’t stretch too far.

- Define your non-negotiables. Once you know the numbers work, figure out your must-haves. This includes your desired location, commute, layout, school district, lifestyle needs, etc. Getting clear on these now makes decisions easier once you start looking at homes.

- Choose your agent early. Look at reviews online and talk to multiple agents to find one you trust that you also click with. The right agent does more than show homes. They help you understand pricing, competition, timing, and strategy before you ever write an offer.

Thinking about Buying Later in the Year? This Is Still Your Window To Prepare

Even if buying feels like a late-2026 goal, this moment still matters. The buyers who feel the most confident later are usually the ones who quietly prepared earlier.

That doesn’t mean big financial commitments or major lifestyle changes. It just means setting yourself up so you’re ready when the timing is right. Here are a few low-stress ways to do that:

- Work on your credit. While you don’t need to have perfect credit to buy a home, your score can have an impact on your loan terms and even your mortgage rate. So, working to bring up your score has its perks. Paying down debt now and making payments on time can help bring your score up.

- Automate your savings. If you have to remember to transfer money into your homebuying savings manually, you may forget to do it. So, you may want to set up automatic transfers to drive consistency and remove the temptation to spend the money elsewhere.

- Lean into your side hustles: Do you have a gig you do (or have done before) to net some extra cash? Taking on part-time work, freelance jobs, or picking up a side hustle can help give your savings a boost.

- Put any unexpected cash to good use: If you get any sudden windfalls, like a tax refund, bonus, inheritance, or cash gift from family, put it toward your house fund. You’ll thank yourself later.

The common thread here? The right prep work makes a difference.

Bottom Line

If buying a home in 2026 is on your radar, let’s start the conversation today. Not to rush a decision, but to make sure you know how to get ready for your moment.

Because every move (whether it’s next year or later) is smoother when it starts with a plan. And if you need help coming up with one that works, let’s connect.

Why Buying a Home Still Pays Off in the Long Run

Renting can feel much less expensive and much simpler than buying a home, especially right now. No repairs, no property taxes, no worrying about mortgage rates – you just pay the bill and move on with your life.

But here’s the part people don’t talk about enough: renting doesn’t help you build your financial future. Meanwhile, homeowners grow their net worth just by owning a home.

So, if you’ve been wondering whether buying is still worth it, the long-term math is clearer than you might think.

Renting vs. Owning: How the Costs Really Compare

Let’s break down one of the key differences between renting and buying. When you rent, your payment goes to your landlord, and then it’s gone. When you own, part of your payment comes back to you in the form of equity (the wealth you build as the value of your home increases, and you pay down your home loan).

So, while renting may seem more affordable now, you have to remember it comes at a long-term cost: you’re not building your wealth. And it turns out, that’s a bigger miss than you may expect.

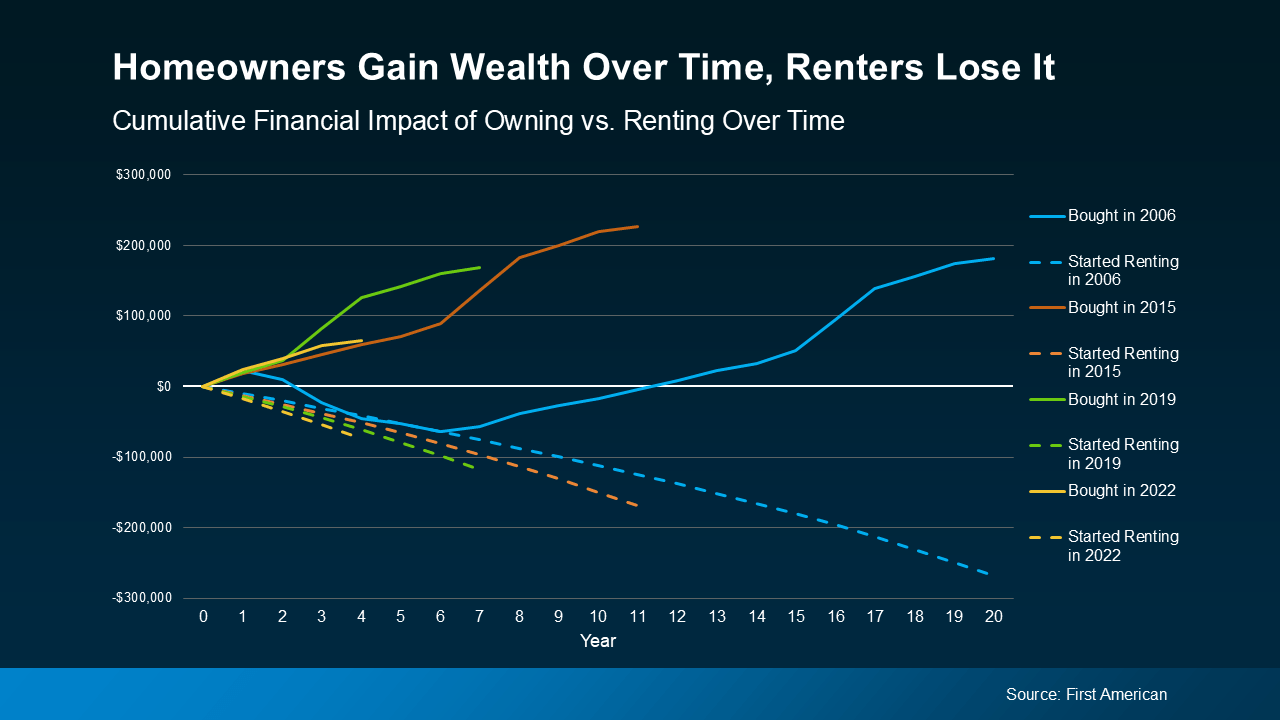

First American recently analyzed the long-term financial impact of renting versus owning a home. They compared mortgage payments, property tax, insurance, repairs, and maintenance against the equity gained through home price appreciation and paying down the mortgage. And they did that during several different time frames to see if it tells a consistent story:

- 2006: the start of the housing bubble

- 2015: 10 years ago

- 2019: just before the pandemic (the last normal years in the market)

- 2022: when mortgage rates jumped

In each time frame, two things were true: renters ended up losing money over time. And homeowners gained it.

Here’s some data so you can see this play out. Each color represents one of the key time frames. The solid lines show the buyer’s investment over time and how their net worth actually grew the longer they lived in their home. The dashed line represents the renter’s investment. In the end, they sank more and more cash into renting without gaining any financial benefit.

The takeaway is simple: time in a home builds wealth. Time renting doesn’t.

The takeaway is simple: time in a home builds wealth. Time renting doesn’t.

Basically, homeowners come out ahead. And the analysis shows that’s even after you factor in the other expenses that come with homeownership, like insurance, repairs, and property taxes. And that’s the case for every time frame First American looked into.

On the flip side, renters spent money on their rent, but didn’t gain any long-term financial benefit. That’s true no matter what window of time you look at in the study.

Now, that doesn’t mean buying always beats renting in the short term. But the longer you own, the wider the wealth gap becomes.

Affordability Is Starting To Improve

You might still be thinking, “Okay, but buying feels out of reach for me right now.” Fair.

The past few years haven’t been easy for buyers. But things are starting to shift. Mortgage rates have come down this year, home prices are softening, and incomes have been rising. And according to Zillow, typical monthly payments have gotten a little easier compared to this time last year. Not by a lot, but enough to make a difference.

No, buying isn’t suddenly easy. But it is easier than it was just a few months ago. And in the long run, history shows it’s worth it.

Bottom Line

Renting may feel less expensive today, but owning is what builds real wealth over time. And with affordability starting to improve, the path to homeownership may be opening up more than you think.

If you’re curious what buying could look like for you, let’s connect. We can figure out your next move, pressure-free.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

This May Be the Best Time To Buy a Brand-New Home

New home construction today is giving buyers something it feels like they haven’t gotten much lately: a real shot at both the home they want and the deal they need. More brand-new options are on the market right now, and builders are rolling out incentives that make these homes more affordable than many people expect.

It’s a combination that doesn’t come around often – and it’s putting buyers in a surprisingly strong position this season. Here’s why this moment matters and why it’s worth partnering with your own local agent to take advantage of it.

1. More New Homes Are Available Now – and That May Not Last

There’s more new construction on the market today than normal. And for buyers, that means:

- More cutting-edge communities

- More move-in-ready homes

- More floor plans to pick from

- More upgraded designs and modern features

But that variety may not last.

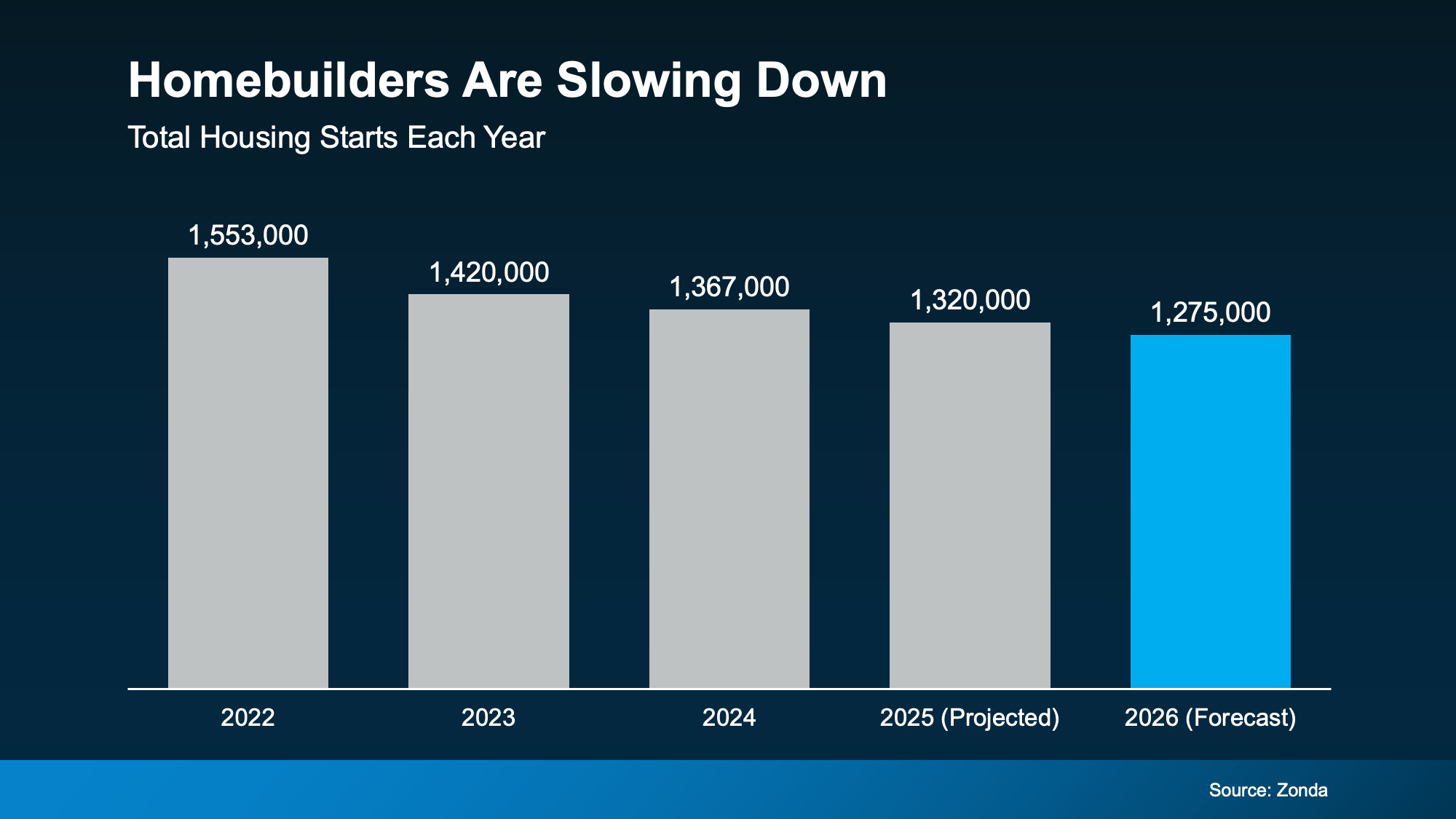

Data from Zonda shows that even though it feels like new homes are popping up just about everywhere, builders have actually started pulling back. The number of starts (that’s when builders break ground) has been slowly but steadily declining over the past few years. And that’s good because it prevents overbuilding nationally.

But here’s the real insight that can give you an edge. Forecasts show that slight downward trend should continue next year (see graph below):

It’s a signal that the new inventory we have now may be your widest pool of all-new options for a while.

It’s a signal that the new inventory we have now may be your widest pool of all-new options for a while.

Today, Redfin says roughly 1 in 3 homes (27%) on the market are new builds. That’s higher than the norm, but the lowest share in four years. And it makes sense based on the graph above.

That means if you want more options to choose from, now’s the time to look.

And if you’re wondering: why the pullback? It’s simple. Since there are already more new homes for sale than usual, builders want to focus on selling down the supply they already have on the market rather than adding more new homes. And that leads to point two.

2. Builder Incentives Just Hit an All-Time High

Here’s where things get even better for buyers. To make sure the inventory they have now keeps moving, builders are offering incentives at levels not seen in years – and many of those perks directly help buyers with affordability. Buyers today are getting:

- Lower Prices: Builders are dropping the prices on their brand-new homes to draw in buyers.

- Help with Closing Costs: Some builders are covering thousands of dollars in fees to reduce the upfront cost of buying.

- Extra Upgrades: Think premium finishes, appliance packages, and designer features, all added at no extra cost.

- Mortgage Rate Buydowns: This is when the builder pays to get you a lower mortgage rate, which reduces your monthly payments and helps with affordability.

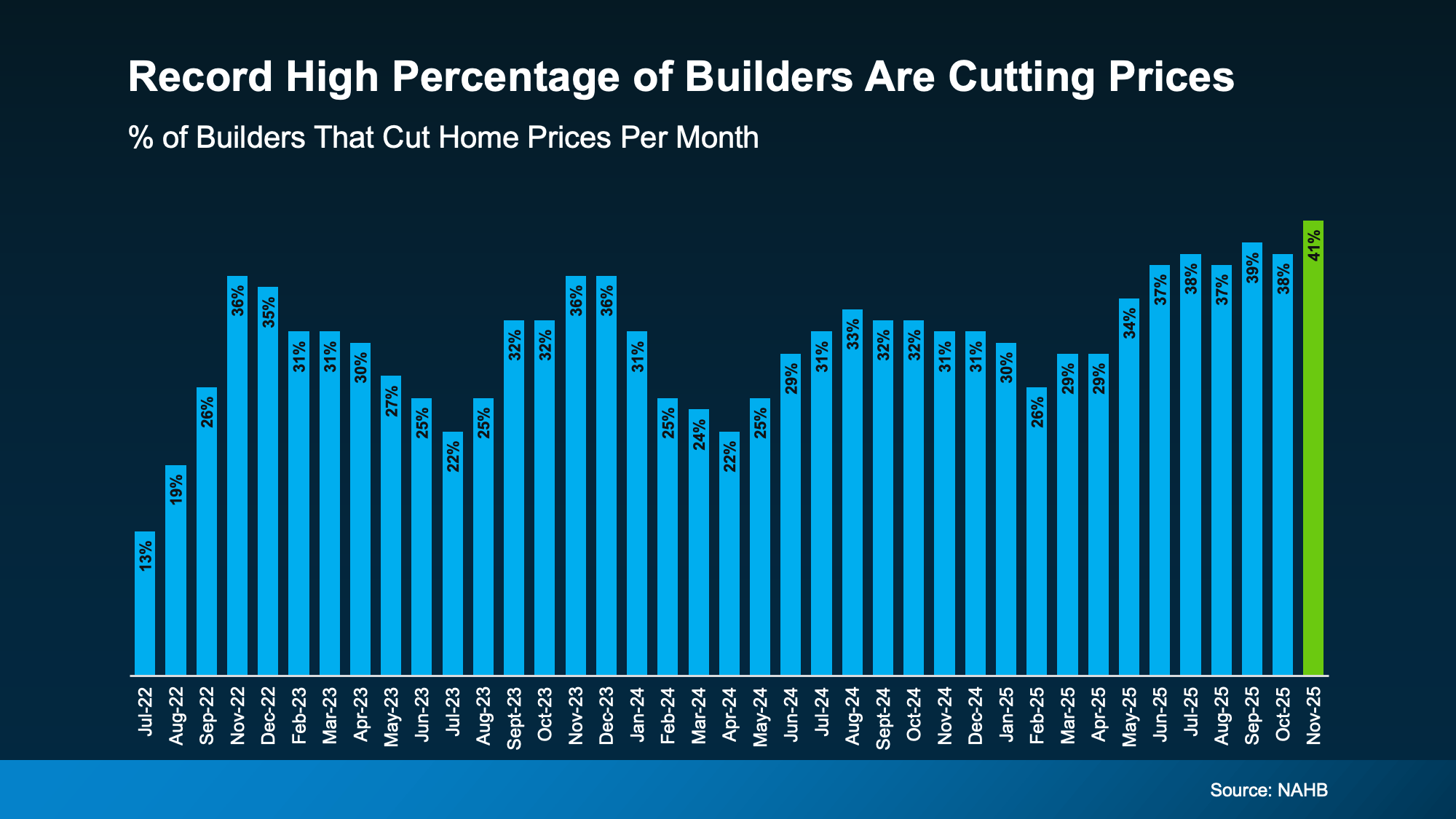

But you don’t have to be lucky to see these types of perks. The truth is, the vast majority of builders are offering advantages like these right now. According to the National Association of Homebuilders (NAHB) 65% of builders say they’re using some type of sales incentive and:

“. . . 41% of builders reported cutting prices in November, a record high in the post-Covid period and the first time this measure has passed 40%.”

That’s a big deal. It shows how willing builders are to negotiate right now.

That’s a big deal. It shows how willing builders are to negotiate right now.

And if you look closely at the graph, you’ll notice the use of incentives typically falls in the early part of the year, as buyer demand rises going into the spring. So, you have an edge if you act now. This may be your ideal window to find the most options and better prices.

If you lean on your own agent and you’re savvy about what you ask for, you could walk away with some of the best perks buyers have seen in years. And when every dollar counts and any incentive helps your bottom line, that’s worth looking into.

More options and more savings = an offer too good to pass up.

Bottom Line

With most builders offering generous incentives and a wider selection of new homes for sale, buyers may be looking at one of the best times in years to buy a new build.

Let’s connect if you want to know which communities, builders, and incentives offer the most value today. Having your own agent (not the builder’s representative) makes the sale and negotiation process that much easier for you.

If you could have a brand-new home for less than you may expect, would you be interested?

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Planning To Sell in 2026? Start the Prep Now

You’ve got big plans for 2026. But what you do this year could be the difference between a smooth sale and a stressful one. If you’re thinking of selling next spring (the busiest season in real estate), the smartest move you can make is to start prepping now. As Realtor.com says:

“If you’re aiming to sell in 2026, now is the time to start preparing, especially if you want to maximize the spring market’s higher buyer activity.”

Because the reality is, from small repairs to touch-ups and decluttering, the earlier you start, the easier it’ll be when you’re ready to list. And, the better your house will look when it’s time for it to hit the market.

Why Starting Now Matters

Talk to any good agent and they’ll tell you that you can’t afford to skip repairs in today’s market. There are more homes for sale right now than there have been in years. And since buyers have more to choose from, your house is going to need to look its best to stand out and get the attention it deserves.

Now, that doesn’t mean you have to do a full-on renovation. But it does mean you’ll want to tackle some projects before you sell. Your house will sell if it’s prepped right. And you don’t want to be left scrambling in the spring to get the work done.

Because here’s the advantage you have now. If you start this year, you’ll be able to space those upgrades and fixes out however you want to. More time. Less stress. No sense of being rushed or racing the clock.

Whether it’s fixing that leaky faucet, repainting your front door, or finally replacing your roof, you can do it right if you start now. And you have the time to find great contractors without blowing your budget or paying extra for rushed jobs.

Get an Agent’s Advice Early

To figure out what’s worth doing and what’s not in your market, you need to talk to a local agent early. That way you’re not wasting your time or money on something that won’t help your bottom line. As Realtor.com explains:

“Respondents overwhelmingly agree that both buyers and sellers enjoy a smoother, more successful experience when they start early. In fact, a recent survey reveals that, for sellers, bringing a real estate agent into the process sooner can pay off significantly.”

A skilled agent can tell you:

- What buyers in your local area are looking for

- The repairs or updates you need to do before you list

- How to prioritize the projects, if you can’t do them all

- Skilled local contractors who can help you get the work done

And having that information up front is a game changer.

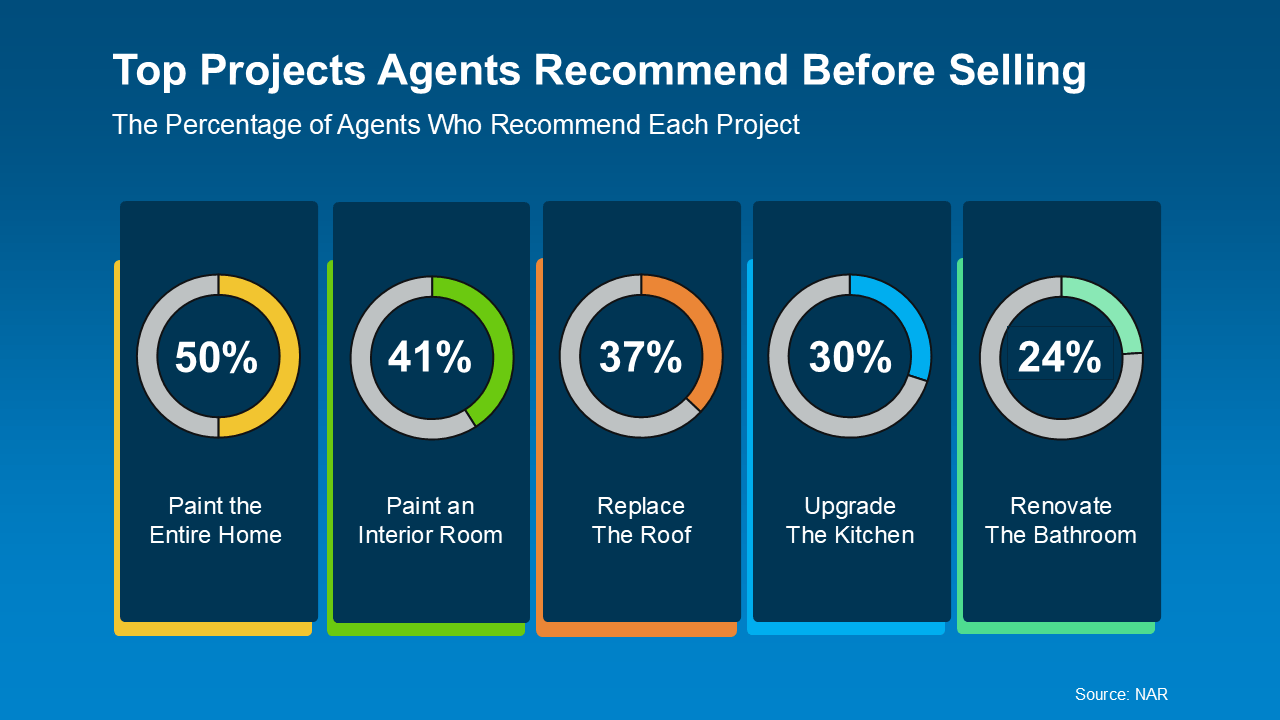

To give you a rough idea of what may come up in that conversation, here are the most common updates agents are recommending today, according to research from the National Association of Realtors (NAR):

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.

Your agent will walk you through what you need to do for your specific house and market. And that’s expertise that’ll really pay off.

Bottom Line

If your plan is to sell in 2026, it’s time to get serious. Taking some time to prep means you’ll hit the market confident, ready, and ahead of other sellers who waited until January to get started.

Want to know which projects are getting the biggest return on their investment in our market? Let’s connect so you can head into next spring with a solid game plan.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link