The Reason Homes Feel Like They Cost So Much (It’s Not What You Think)

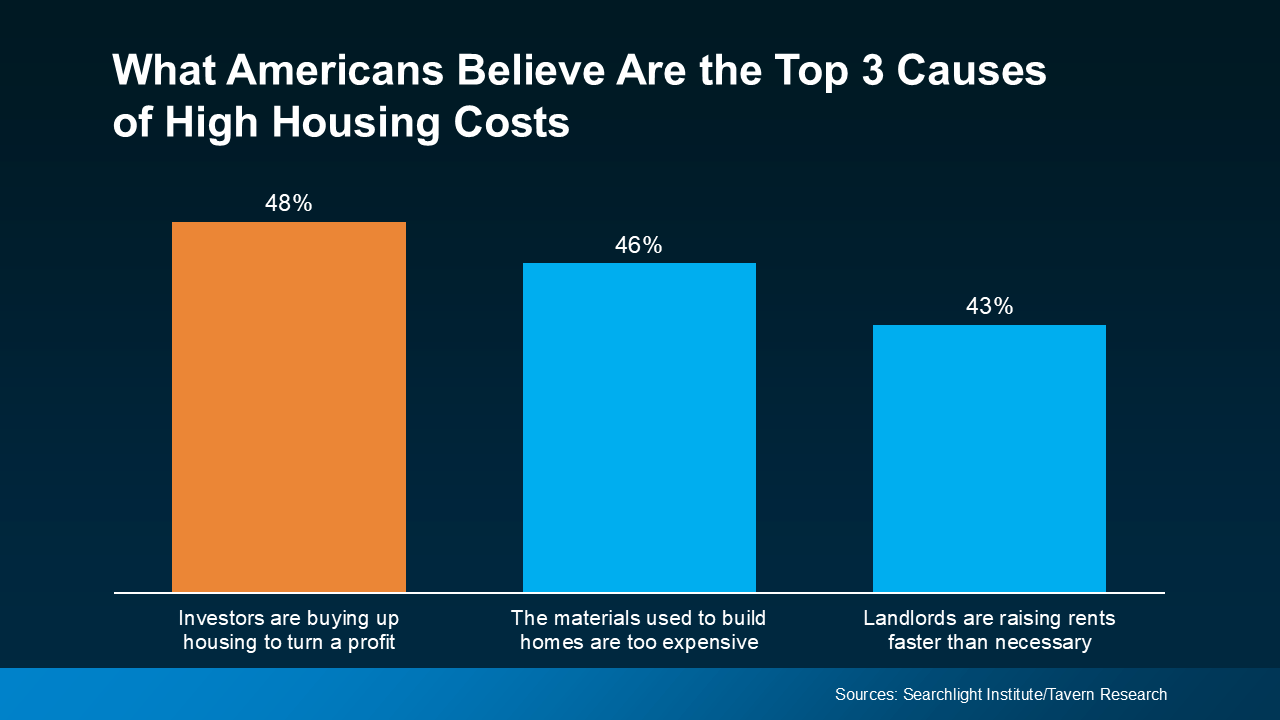

Scroll through your feed and you’ll see plenty of finger-pointing about why homes cost so much. And according to a national survey, a lot of people believe big investors are to blame.

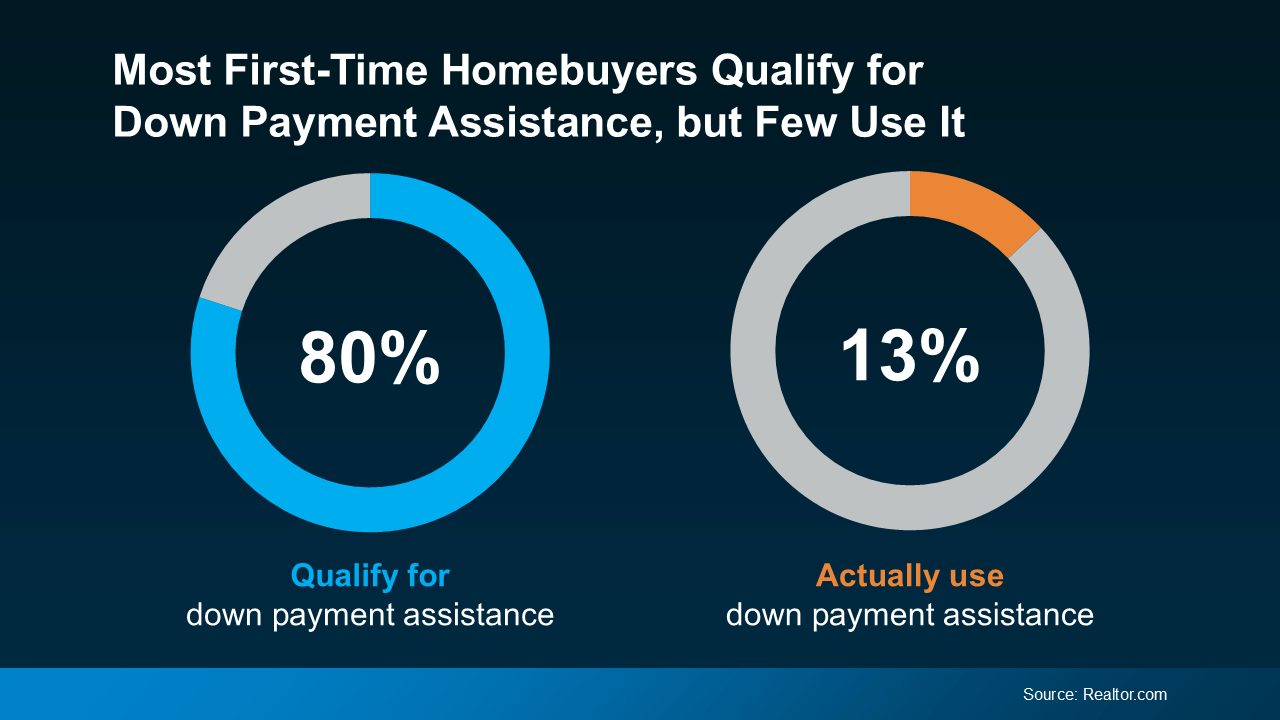

Even though data shows that’s not true, nearly half of Americans surveyed (48%) think investors are the top reason housing feels so expensive (see graph below):

But that theory doesn’t actually hold up once you look at the data.

But that theory doesn’t actually hold up once you look at the data.

The Truth About Investors

Investors do play a role in the housing market, especially in certain areas. But they’re not buying up all the homes like so many people on social media say.

Nationwide, Realtor.com found only 2.8% of all home purchases last year were made by big investors (who own more than 50 properties). That means roughly 97% of homes were bought and sold by regular people, not corporate giants. Danielle Hale, Chief Economist at Realtor.com, explains:

“Investors do own significant shares of the housing stock in some neighborhoods, but nationwide, the share of investor-owned housing is not a major concern.”

So, if it’s not investors, why are home prices so high?

What’s Really Behind Today’s Home Prices

The real story behind rising prices has less to do with who’s buying and more to do with what’s missing: enough homes. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), says:

“It’s been popular among some to blame investors, but with housing, the economics of that don’t make a lot of sense. The fundamental driver of housing costs is the shortage itself—it’s driven by the fact that there’s a mismatch between the number of households and the actual size of the housing stock.”

There simply haven’t been enough homes for sale to meet buyer demand. And that shortage, not investor activity, is what’s pushed prices higher just about everywhere.

Bottom Line

It’s easy to believe investors caused today’s housing challenges. But the truth is, the market just needs more homes, and that’s finally starting to happen.

As more options hit the market, buying may feel a little more realistic again.

Let’s connect and talk about what’s happening in our local market.

What Buyers Say They Need Most (And How the Market’s Responding)

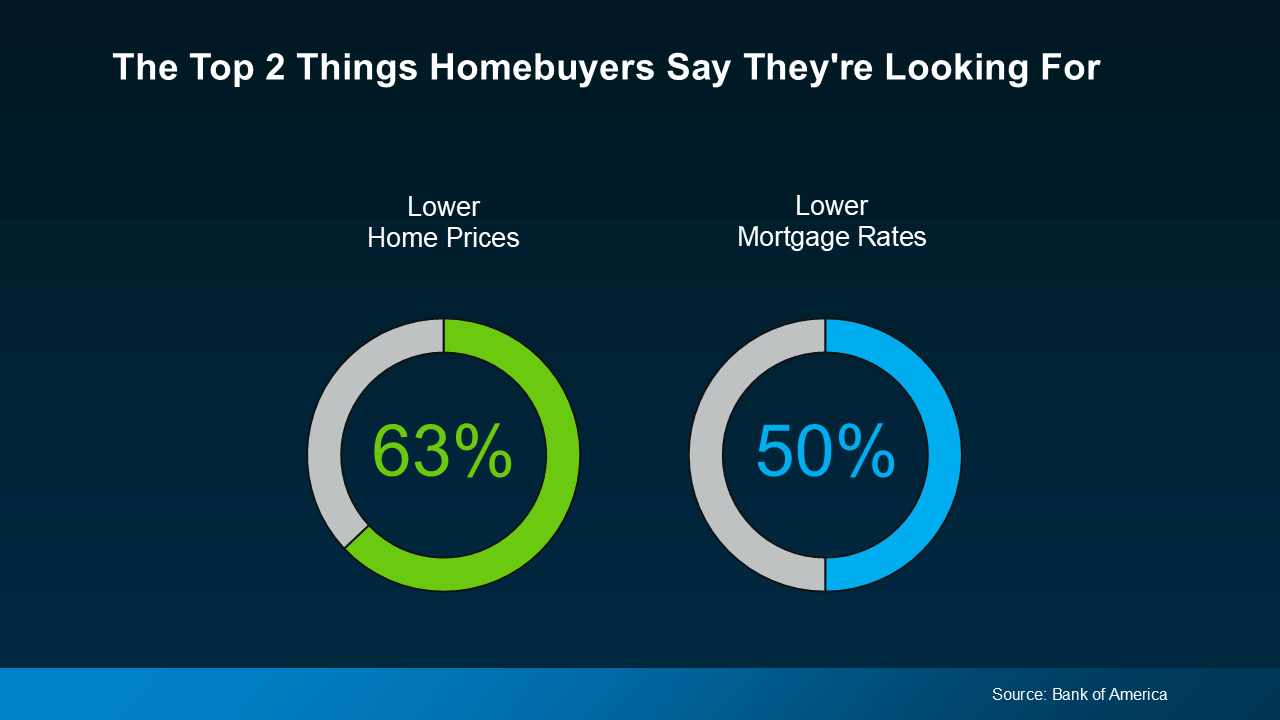

A recent survey from Bank of America asked would-be homebuyers what would help them feel better about making a move, and it’s no surprise the answers have a clear theme. They want affordability to improve, specifically prices and rates (see below):

Here’s the good news. While the broader economy may still feel uncertain, there are signs the housing market is showing some changes in both of those areas. Let’s break it down so you know what you’re working with.

Here’s the good news. While the broader economy may still feel uncertain, there are signs the housing market is showing some changes in both of those areas. Let’s break it down so you know what you’re working with.

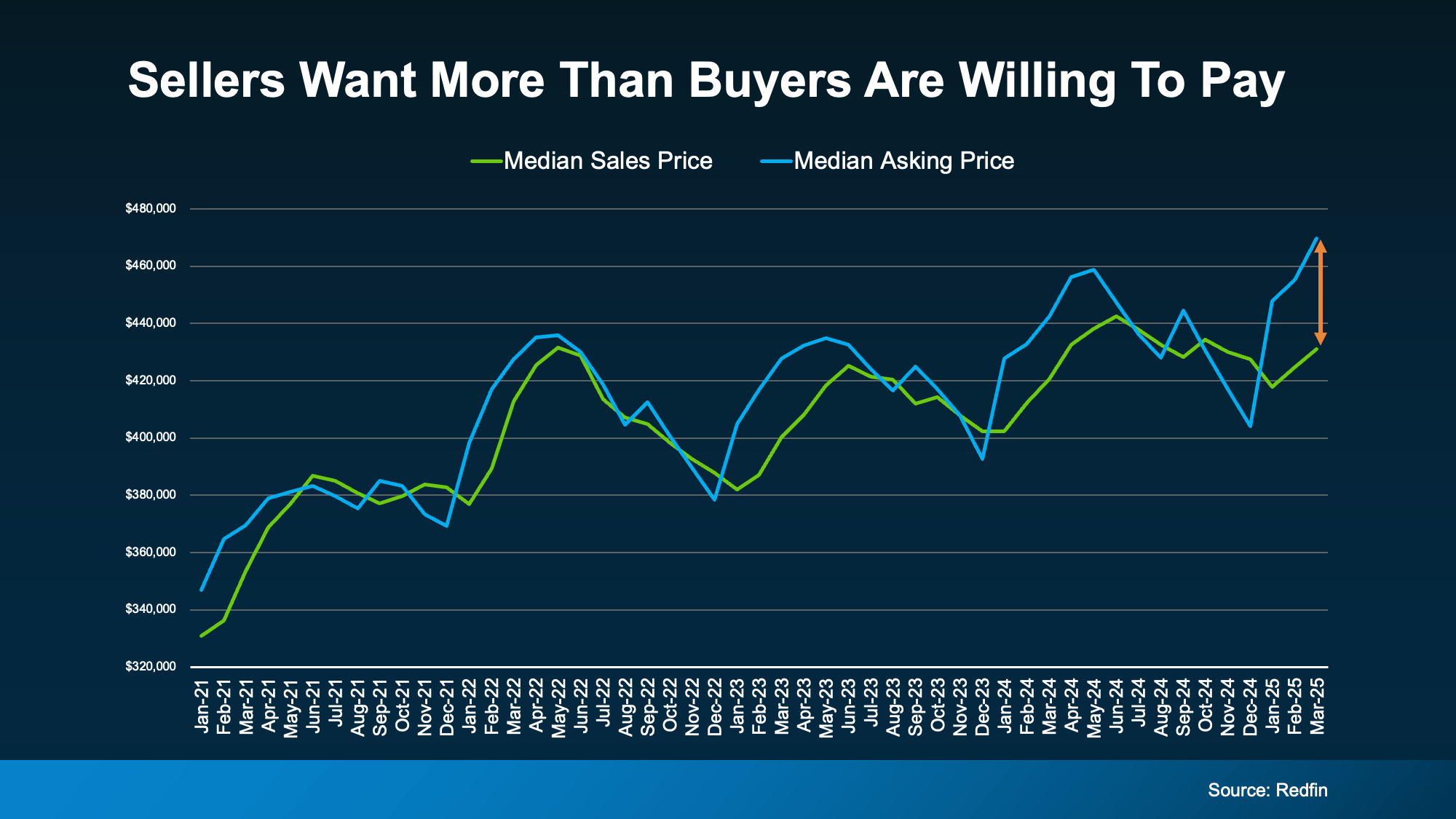

Prices Are Moderating

Over the past few years, home prices climbed fast, sometimes so fast it left many buyers feeling shut out. But today, that pace has slowed down. For comparison, from 2020 to 2021, prices rose by 20% in a 12-month period. Now? Nationally, experts are projecting single-digit increases this year – a much more normal pace.

That’s a sharp contrast to the rapid growth we saw just a few short years ago. Just remember, price trends are going to vary by area. In some markets, prices will continue to rise while others will experience slight declines.

Prices aren’t crashing, but they are moderating. For buyers, the slowdown makes buying a home a bit less intimidating. It’s easier to plan your budget when home values are moving at a much slower pace.

Mortgage Rates Are Easing

At the same time, rates have come down from their recent highs. And that’s taken some pressure off would-be homebuyers. As Lisa Sturtevant, Chief Economist at Bright MLS, says:

“Slower price growth coupled with a slight drop in mortgage rates will improve affordability and create a window for some buyers to get into the market.”

Even a small drop in mortgage rates can mean a big difference in what you pay each month in your future mortgage payment. Just remember, while rates have come down a bit lately, they’re going to experience some volatility. So don’t get too caught up in the ups and downs.

The overall trend in the year ahead is that rates are expected to stay in the low to mid-6s – which is a lot better than where they were just a few short months ago. They may even drop further, depending on where the economy goes from here.

Why This Matters

Confidence in the economy may be low, but the housing market is showing signs of adjustment. Prices are moderating, and rates have come down from their highs.

For you, that may not solve affordability challenges altogether, but it does mean conditions look a little different than they did earlier this year. And those shifts could help you re-engage as we move into next year.

Bottom Line

Both of the top concerns for buyers are seeing some movement. Prices are moderating. Rates are easing. And both trends could stick around going into 2026.

If you’re considering a move, let’s connect walk you through what’s happening in our area – and what it means for your plans.

Why October Is the Best Time To Buy a Home in 2025

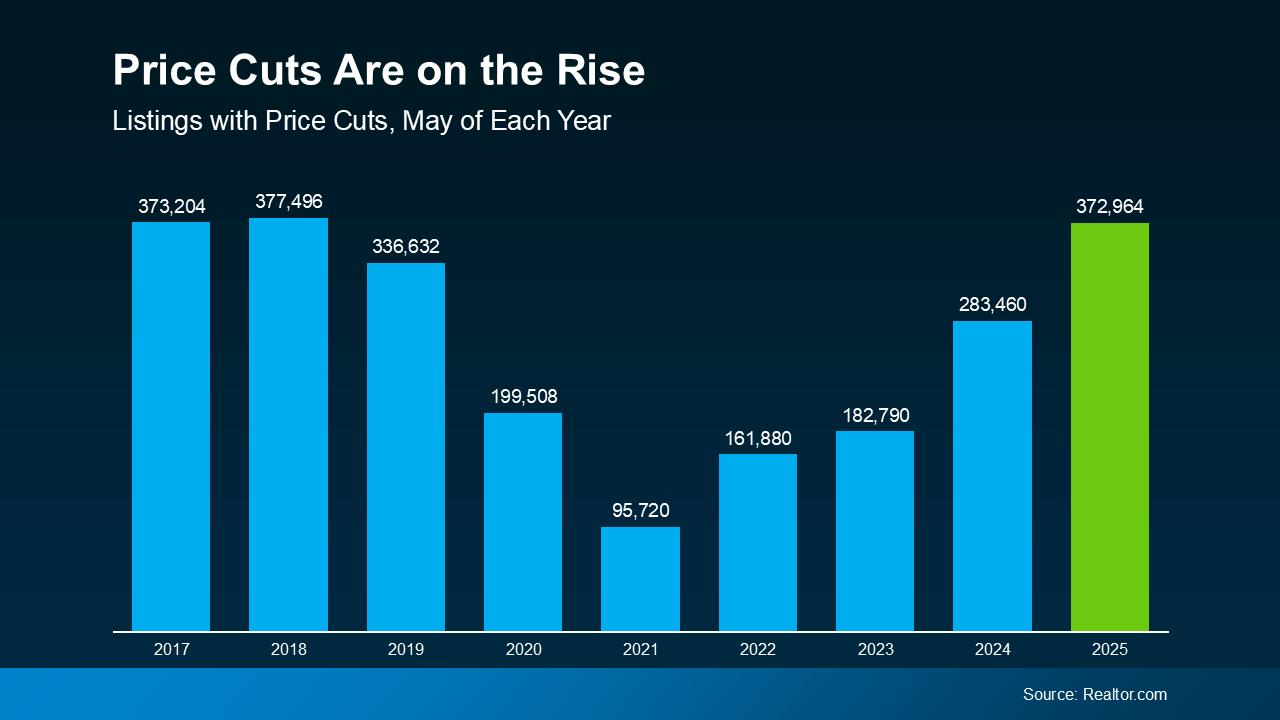

If you’ve been watching from the sidelines, now’s the time to lean in. It’s officially the best time to buy this year. According to Realtor.com, this October will have the most buyer-friendly conditions of any month in 2025:

“By mid-October, buyers across much of the country may finally find the combination of inventory, pricing, and negotiating power they’ve been waiting for—a rare opportunity in a market that has been tight for most of the past decade.”

So, if you’re ready and able to buy right now, shooting for this month means you should see:

- More homes to choose from

- Less competition from other buyers

- More time to browse

- Better home prices

- Sellers who are more willing to negotiate

Just remember, every market is different. For most of the top 50 largest metros, that sweet spot falls in October. But the peak time to buy may be slightly earlier or later, depending on where you live. As Realtor.com explains:

“While Oct. 12–18 is the national “Best Week,” timing can shift depending on the local markets. . .”

Best Week To Buy for the Top 50 Largest Metro Areas

- Atlanta-Sandy Springs-Roswell, GA: September 28 – October 4

- Austin-Round Rock-San Marcos, TX: September 28 – October 4

- Baltimore-Columbia-Towson, MD: October 12 – 18

- Birmingham, AL: October 19 – 25

- Boston-Cambridge-Newton, MA-NH: October 26 – November 1

- Buffalo-Cheektowaga, NY: October 12 – 18

- Charlotte-Concord-Gastonia, NC-SC: November 2 – 8

- Chicago-Naperville-Elgin, IL-IN: September 28 – October 4

- Cincinnati, OH-KY-IN: October 12 – 18

- Cleveland, OH: October 12 – 18

- Columbus, OH: October 12 – 18

- Dallas-Fort Worth-Arlington, TX: September 28 – October 4

- Denver-Aurora-Centennial, CO: October 12 – 18

- Detroit-Warren-Dearborn, MI: October 12 – 18

- Grand Rapids-Wyoming-Kentwood, MI: September 28 – October 4

- Hartford-West Hartford-East Hartford, CT: September 21 – 27

- Houston-Pasadena-The Woodlands, TX: October 12 – 18

- Indianapolis-Carmel-Greenwood, IN: October 26 – November 1

- Jacksonville, FL: October 26 – November 1

- Kansas City, MO-KS: October 12 – 18

- Las Vegas-Henderson-North Las Vegas, NV: October 5 – 11

- Los Angeles-Long Beach-Anaheim, CA: October 12 – 18

- Louisville/Jefferson County, KY-IN: November 2 – 8

- Memphis, TN-MS-AR: September 21 – 27

- Miami-Fort Lauderdale-West Palm Beach, FL: November 30 – December 6

- Milwaukee-Waukesha, WI: September 7 – 13

- Minneapolis-St. Paul-Bloomington, MN-WI: October 26 – November 1

- Nashville-Davidson–Murfreesboro–Franklin, TN: October 12 – 18

- New York-Newark-Jersey City, NY-NJ: September 14 – 20

- Oklahoma City, OK: October 12 – 18

- Orlando-Kissimmee-Sanford, FL: October 26 – November 1

- Philadelphia-Camden-Wilmington, PA-NJ-DE-MD: September 7 – 13

- Phoenix-Mesa-Chandler, AZ: November 2 – 8

- Pittsburgh, PA: October 12 – 18

- Portland-Vancouver-Hillsboro, OR-WA: October 26 – November 1

- Providence-Warwick, RI-MA: October 19 – 25

- Raleigh-Cary, NC: October 12 – 18

- Richmond, VA: October 26 – November 1

- Riverside-San Bernardino-Ontario, CA: September 28 – October 4

- Sacramento-Roseville-Folsom, CA: October 12 – 18

- San Antonio-New Braunfels, TX: October 12 – 18

- San Diego-Chula Vista-Carlsbad, CA: October 12 – 18

- San Francisco-Oakland-Fremont, CA: October 12 – 18

- San Jose-Sunnyvale-Santa Clara, CA: October 19 – 25

- Seattle-Tacoma-Bellevue, WA: October 19 – 25

- St. Louis, MO-IL: October 12 – 18

- Tampa-St. Petersburg-Clearwater, FL: November 30 – December 6

- Tucson, AZ: October 12 – 18

- Virginia Beach-Chesapeake-Norfolk, VA-NC: September 21 – 27

- Washington-Arlington-Alexandria, DC-VA-MD-WV: October 12 – 18

What the Experts Are Saying

And Realtor.com isn’t the only one saying you’ve got an opportunity if you move now. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Homebuyers are in the best position in more than five years to find the right home and negotiate for a better price. Current inventory is at its highest since May 2020, during the COVID lockdown.”

Daryl Fairweather, Chief Economist at Redfin, puts it like this:

“Nationally, now is a good time to buy, if you can afford it . . . with falling mortgage rates and significantly more inventory, buyers have an upper hand in negotiations.”

And NerdWallet says:

“This fall just might be the best window for home buyers in the past five years.”

How To Get Ready for this Golden Window

To make sure you’re ready to jump in whenever your market’s best time to buy arrives, talk to a local agent now. They’ll be able to give you more information on your market’s peak time, why it’s good for you, and the steps you’ll need to take to get ready.

Bottom Line

If you’re serious about buying, getting prepped for this October window is a smart play.

Want help lining up your strategy? Let’s have a quick conversation so you’ve got the information you need to be ready for this prime buying time.

Is It Better To Buy Now or Wait for Lower Mortgage Rates? Here’s the Tradeoff

Mortgage rates are still a hot topic – and for good reason. After the most recent jobs report came out weaker than expected, the bond market reacted almost instantly. And, as a result, in early August mortgage rates dropped to their lowest point so far this year (6.55%).

While that may not sound like a big deal, pretty much every buyer has been waiting for rates to fall. And even a seemingly small drop like this reignites the hope we’re finally going to see rates trending down. But what’s realistic to expect?

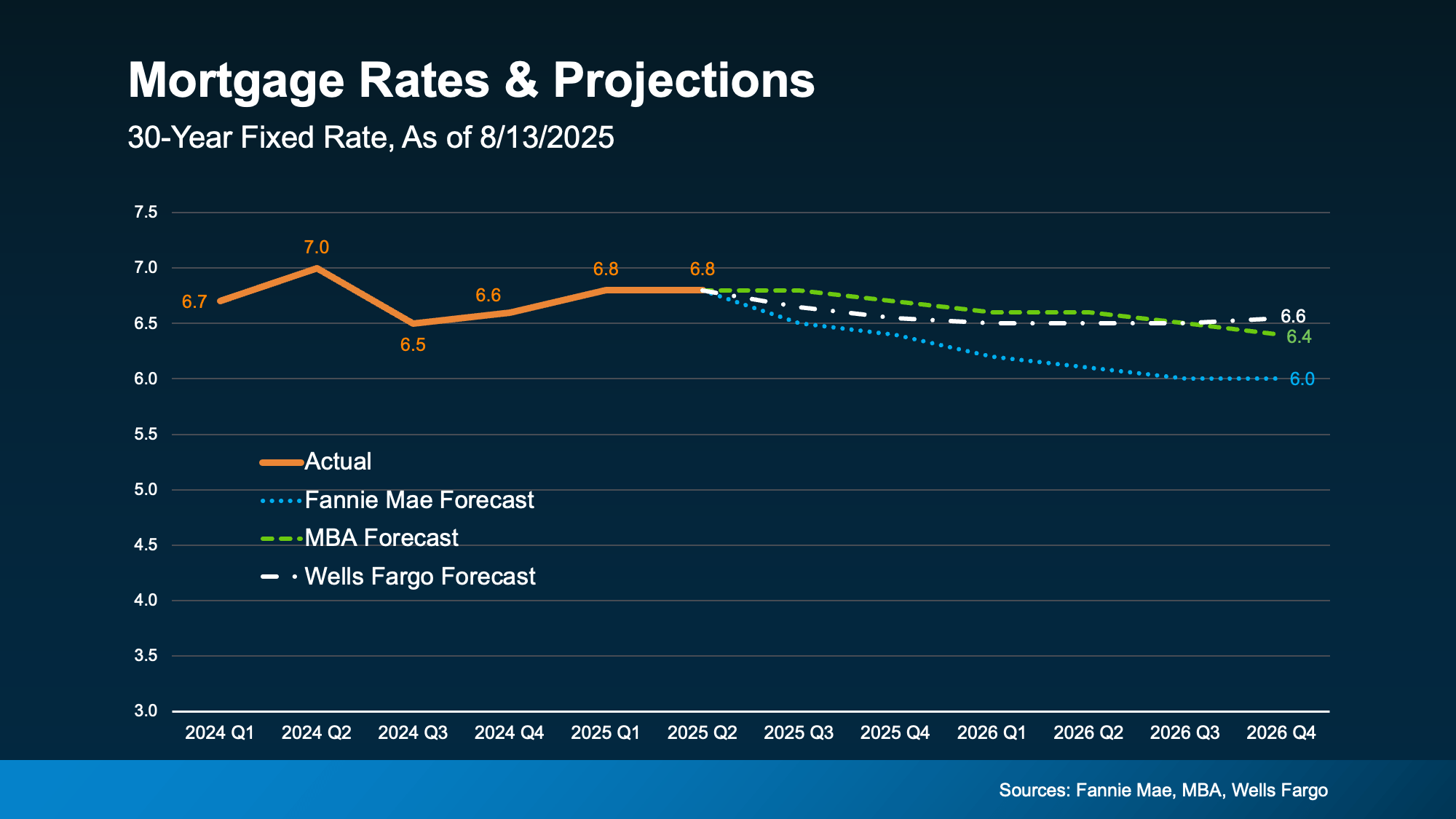

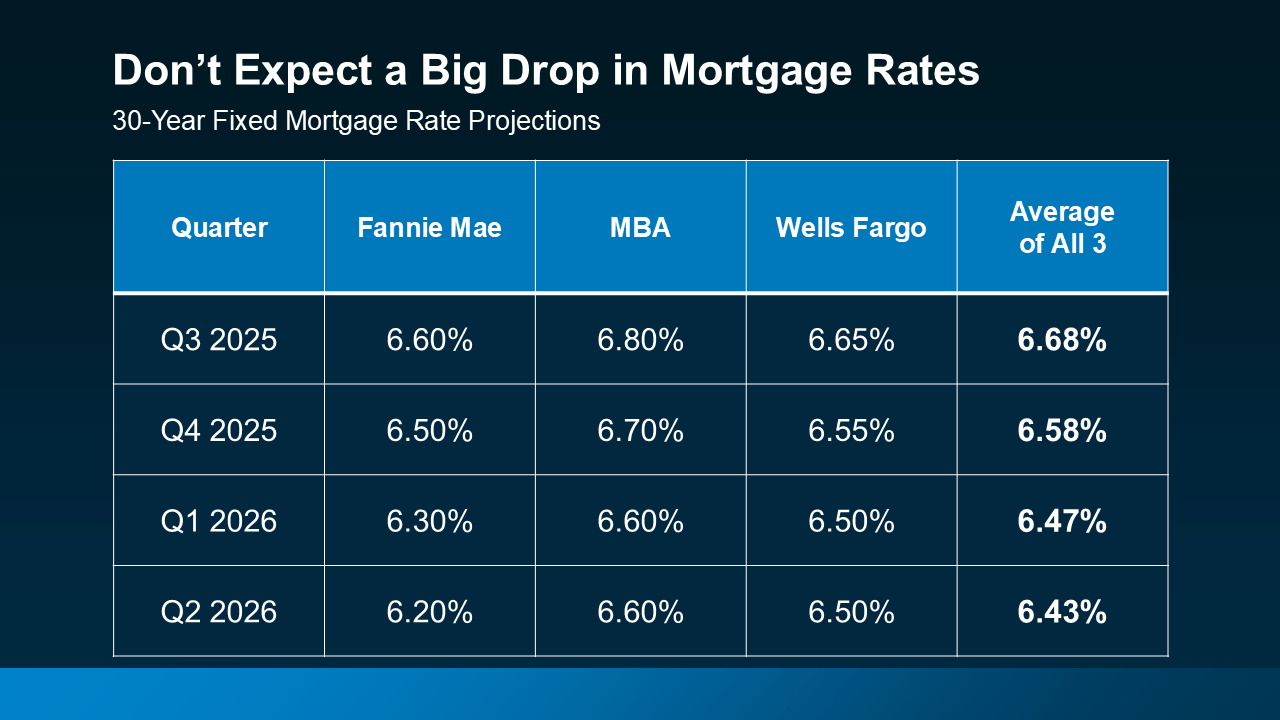

According to the latest forecasts, rates aren’t expected to fall dramatically anytime soon. Most experts project they’ll stay somewhere in the mid-to-low 6% range through 2026 (see graph below):

In other words, no big changes are expected. But small shifts, like the one we just saw, are still likely.

In other words, no big changes are expected. But small shifts, like the one we just saw, are still likely.

Each time there’s changing economic news, there’s a chance mortgage rates will react. And with so many reports coming out this week, we’ll get a better feeling of where the economy and inflation are headed – and how rates will respond.

What Rate Would Get Buyers Moving Again?

The magic number most buyers seem to be watching for is 6%. And it’s not just a psychological benchmark; it has real impact. A recent report from the National Association of Realtors (NAR) says if rates reach 6%:

- 5.5 million more households could afford the median-priced home

- And roughly 550,000 people would buy a home within 12 to 18 months

That’s a lot of pent-up demand just waiting for the green light. And if you look back at the graph above, you’ll see Fannie Mae thinks we’ll hit that threshold next year. That raises an important question: Does it really make sense to wait for lower rates?

Because here’s the tradeoff. If you’re waiting for 6%, you need to realize a lot of other people are too. And when rates do continue to inch down and more buyers jump into the market all at once, you could face more competition, fewer choices, and higher home prices. NAR explains it like this:

“Home buyers wishing for lower mortgage interest rates may eventually get their wish, but for now, they’ll have to decide whether it’s better to wait or jump into the market.”

Consider the unique window that exists right now:

- Inventory is up = more choices

- Price growth has slowed down = more realistic pricing

- You may have more room to negotiate = you could get a better deal

These are all opportunities that will go away if rates fall and demand surges. That’s why NAR says:

“Buyers who are holding out for lower mortgage rates may be missing a key opening in the market.”

Bottom Line

Rates aren’t expected to hit 6% this year. But when they do, you’ll have to deal with more competition as other buyers jump back in. If you want less pressure and more negotiating power, that opportunity is already here – and it might not last for long. It all depends on what happens in the economy next.

Let’s talk about what’s happening in our area and whether it makes sense to make your move now, before everyone else does.

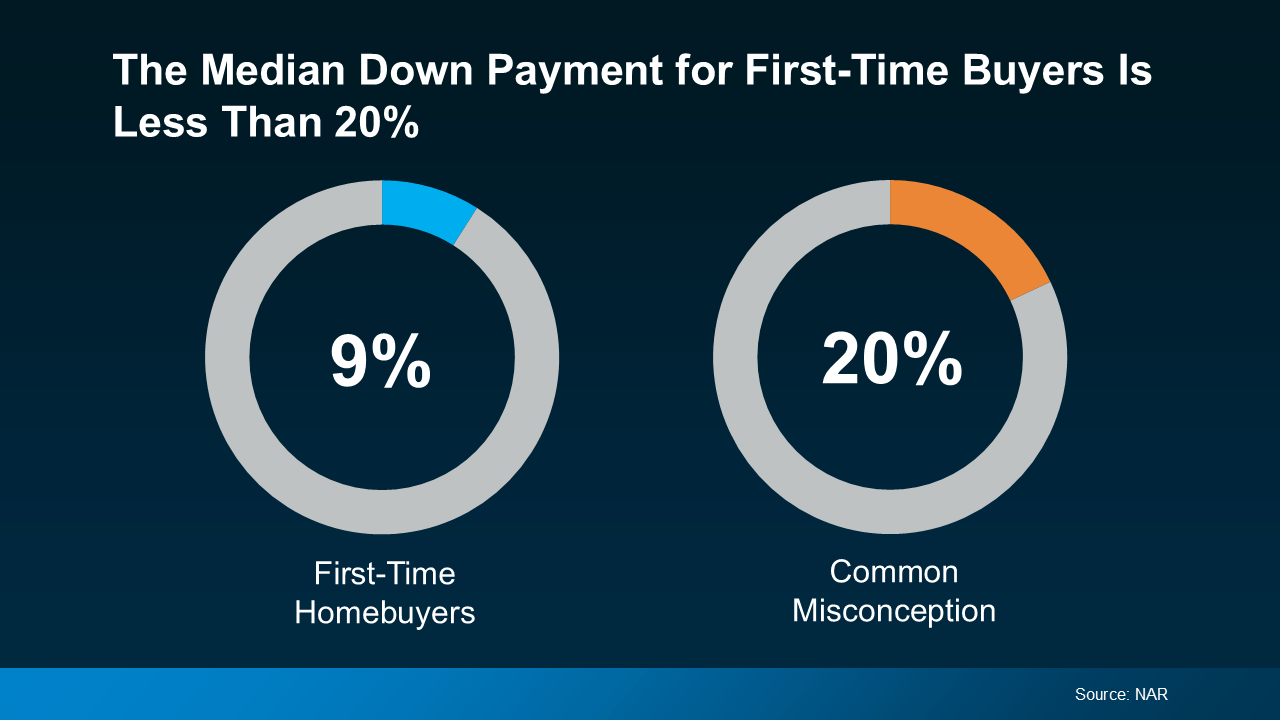

The Truth About Down Payments (It’s Not What You Think)

Buying a home is exciting… until you start thinking about the down payment. That’s when the worry can set in.

“I’ll never save enough.”

“I need a small fortune just to get started.”

“I guess I’ll just rent forever.”

Sound familiar? You’re not alone. And you’re definitely not out of luck.

Here’s the thing: a lot of what you’ve heard about down payments just isn’t true. And once you know the facts, you might realize you’re a lot closer to owning a home than you think.

Let’s break it all down and bust some big down payment myths while we’re at it.

Myth 1: “I need to come up with a big down payment.”

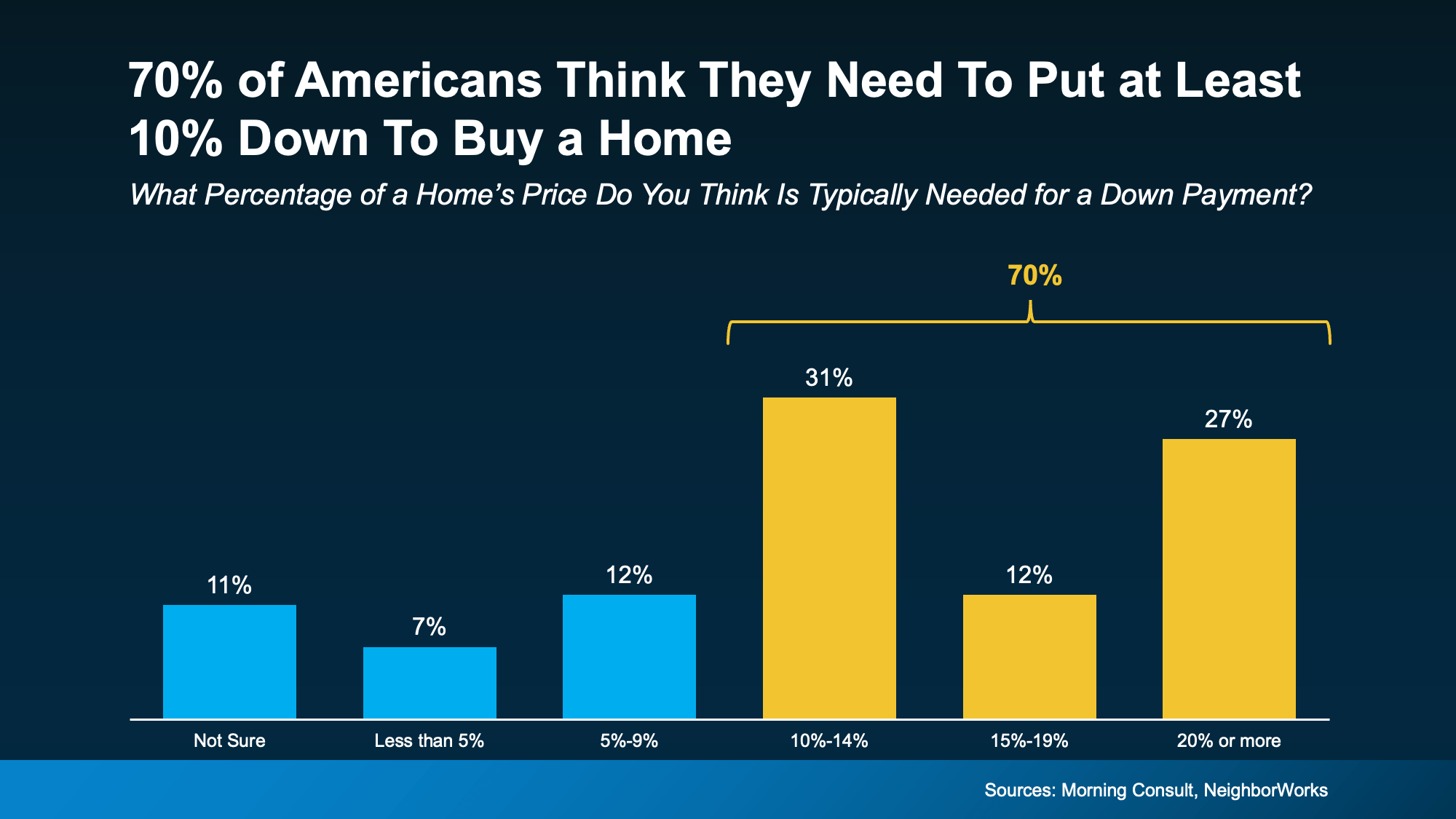

This one stops a lot of people in their tracks. A recent poll from Morning Consult and NeighborWorks shows 70% of Americans think they need to put at least 10% down to buy a home. And 11% aren’t sure what’s required at all (see graph below):

The truth? According to the National Association of Realtors (NAR), the typical down payment for first-time buyers has been between 6% and 9% since 2018. But there’s more to the story. If you qualify for an FHA loan, you may only need to put 3.5% down. And VA loans typically don’t require a down payment at all. So, there are options out there that can really make a difference for some buyers.

The truth? According to the National Association of Realtors (NAR), the typical down payment for first-time buyers has been between 6% and 9% since 2018. But there’s more to the story. If you qualify for an FHA loan, you may only need to put 3.5% down. And VA loans typically don’t require a down payment at all. So, there are options out there that can really make a difference for some buyers.

Myth 2: “It’ll take forever to save up for a down payment.”

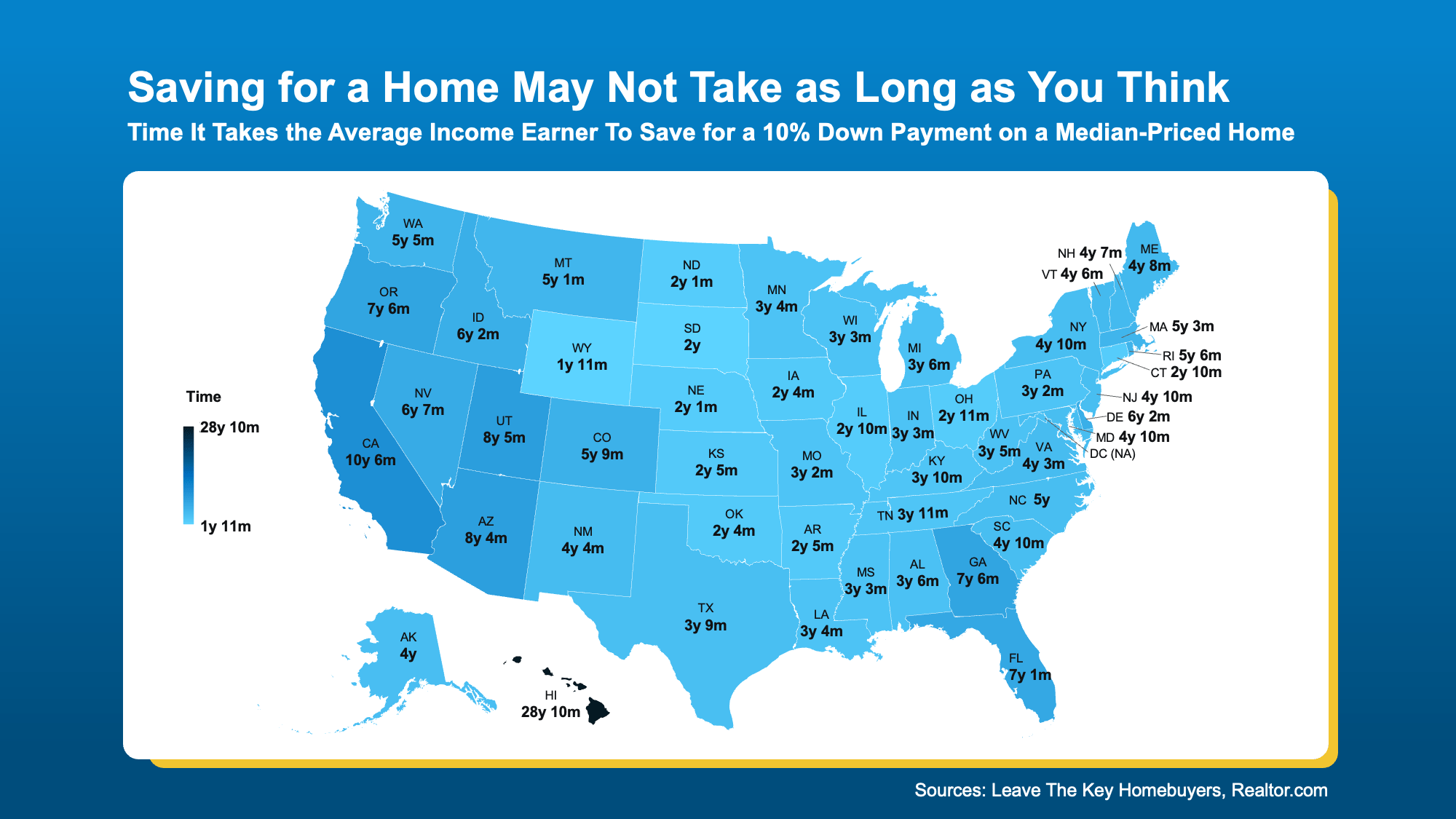

Sure, saving can take time. But it may not have to be as long as you think. In many states, reaching your goal can happen faster than you might expect, especially when you know your budget and have a clear savings plan.

According to a new study, the amount of time varies depending on where you live. The map below shows, on average, how many years it takes to save up for a 10% down payment based on typical home values and income levels in each state (see map below):

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.

Myth 3: “I have to do it all on my own.”

This is one of the biggest myths of all. The reality is, there are thousands of down payment assistance programs out there, and the same poll from Morning Consult and NeighborWorks shows 39% of people don’t even know about them. That means a lot of potential homebuyers could already be closer to homeownership – they just don’t realize it.

These assistance programs are designed to help people like you who are ready to own a home but just need a little support getting started. As Miki Adams, President at CBC Mortgage Agency, explains:

“With high interest rates and soaring home prices, down payment assistance is more essential than ever.”

Bottom Line

If you’ve been putting off buying a home because the down payment feels like too much to tackle, let’s talk. You may not need as much as you think, and there are plenty of resources out there, so you don’t have to do it alone. You just need an expert to point you in the right direction.

If a down payment wasn’t holding you back, would you be ready to start your home search?

Housing Market Forecasts for the Rest of 2025

If you’ve been watching the market, you’ve likely noticed a few changes already this year. But what’s next? From home prices to mortgage rates, here’s what the latest expert forecasts suggest for the rest of 2025 – and what these shifts could mean for you.

Will Home Prices Fall?

Many buyers are hoping home prices will come down soon. And recent headlines about prices dipping in some areas are making some people believe it’s just a matter of time before there’s a bigger drop. But here are the facts.

While home price growth is slowing down, that doesn’t mean we’re headed for a crash. As NAHB explains:

“House price growth slowed . . . partly due to a decline in demand and an increase in supply. Persistent high mortgage rates and increased inventory combined to ease upward pressure on house prices. These factors signaled a cooling market, following rapid gains seen in previous years.”

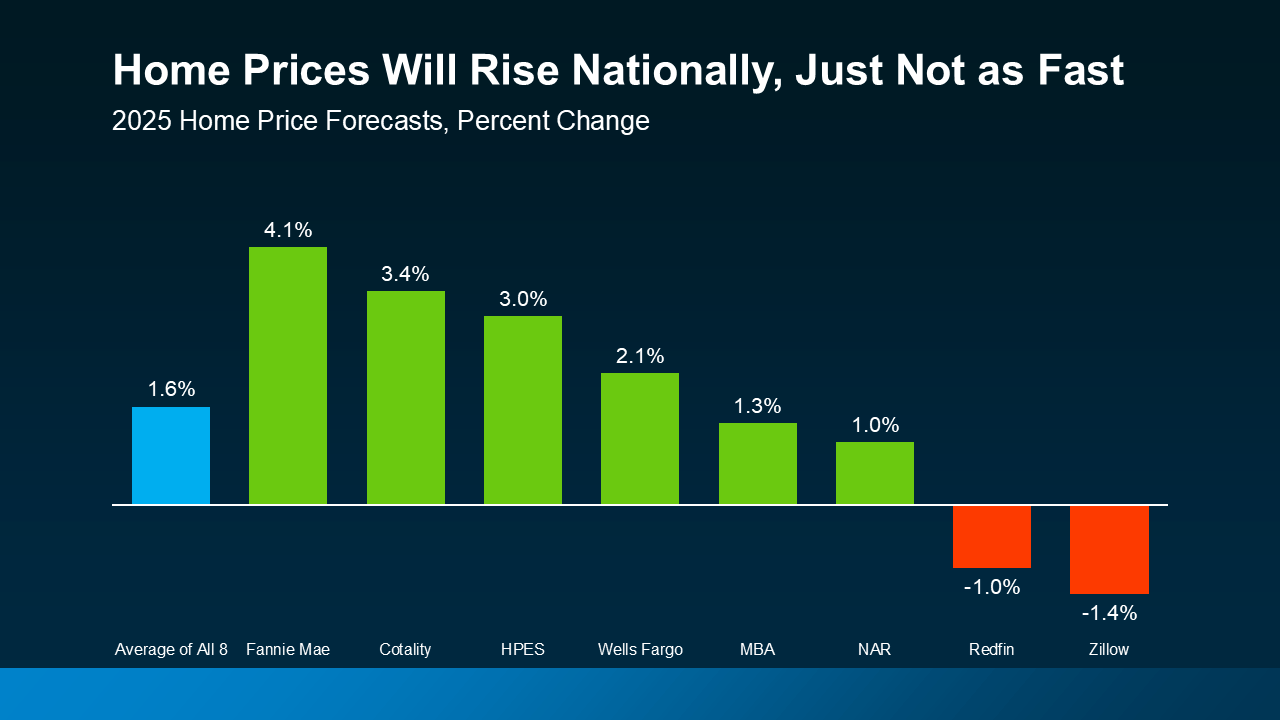

But experts say, even with that slowdown, prices will still rise this year at the national level. The average of 8 leading forecasters shows prices are expected to go up 1.5-2% in 2025 (see graph below):

That means, if you’re waiting for a major drop, experts agree that’s just not in the cards.

That means, if you’re waiting for a major drop, experts agree that’s just not in the cards.

Keep in mind, while some markets are already seeing prices come down slightly, the average dip is just -3.5%. That’s a far cry from the nearly 20% decline the market experienced during the 2008 crash.

Plus, those small changes are easily absorbed when you consider how much home prices have climbed over the past few years. Data from the Federal Housing Finance Agency (FHFA) shows prices are up 55% nationally compared to just 5 years ago.

The takeaway? Prices aren’t crashing. They’re expected to keep climbing – just not as quickly these days. And some may argue they’ll be closer to flat by the end of this year. But, again, this is going to vary by market, with some local ups and downs. So, lean on a pro to see the latest price trends for your area.

Will Mortgage Rates Come Down?

Another common thought among today’s buyers is: I’m just going to wait for rates to come down. But is that a smart strategy? According to Yahoo Finance:

“If you’re looking for a substantial interest rate drop in 2025, you’ll likely be left waiting. The latest news from the Federal Reserve and other key economic data point toward steady mortgage rates on par with what we see today.”

In other words, don’t try to time the market or wait for a drop that may not be coming. Most experts say rates will remain in the 6s, and current projections have them settling in the mid-6% range by the end of this year (see chart below):

And that’s not a big change from where they are right now. So, if you need to move, let’s talk about how to make it happen and what you should watch for. Because while rates may not be as low as you want them to be, you don’t want to put your needs on the back burner, hoping for something the data shows isn’t likely to happen.

And that’s not a big change from where they are right now. So, if you need to move, let’s talk about how to make it happen and what you should watch for. Because while rates may not be as low as you want them to be, you don’t want to put your needs on the back burner, hoping for something the data shows isn’t likely to happen.

Working with an expert who is keeping an eye on all the economic factors that can influence mortgage rates is going to be essential this year. That’s because changes in things like inflation and other key drivers could impact how rates move going forward.

The Takeaway for Buyers and Sellers

Whether you’re buying, selling, or thinking about doing both, this market requires strategy, not guesswork. Prices are still rising nationally (just more slowly), and rates are projected to stay pretty much where they are, so the bigger picture is one of moderation – not a meltdown.

Bottom Line

If you want to make a move, your best bet is to focus on your personal situation – not what the headlines say – and work with a real estate pro who knows how to navigate the shifting conditions in our local market.

Let’s talk about what’s happening in our area to build a plan that works for you.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

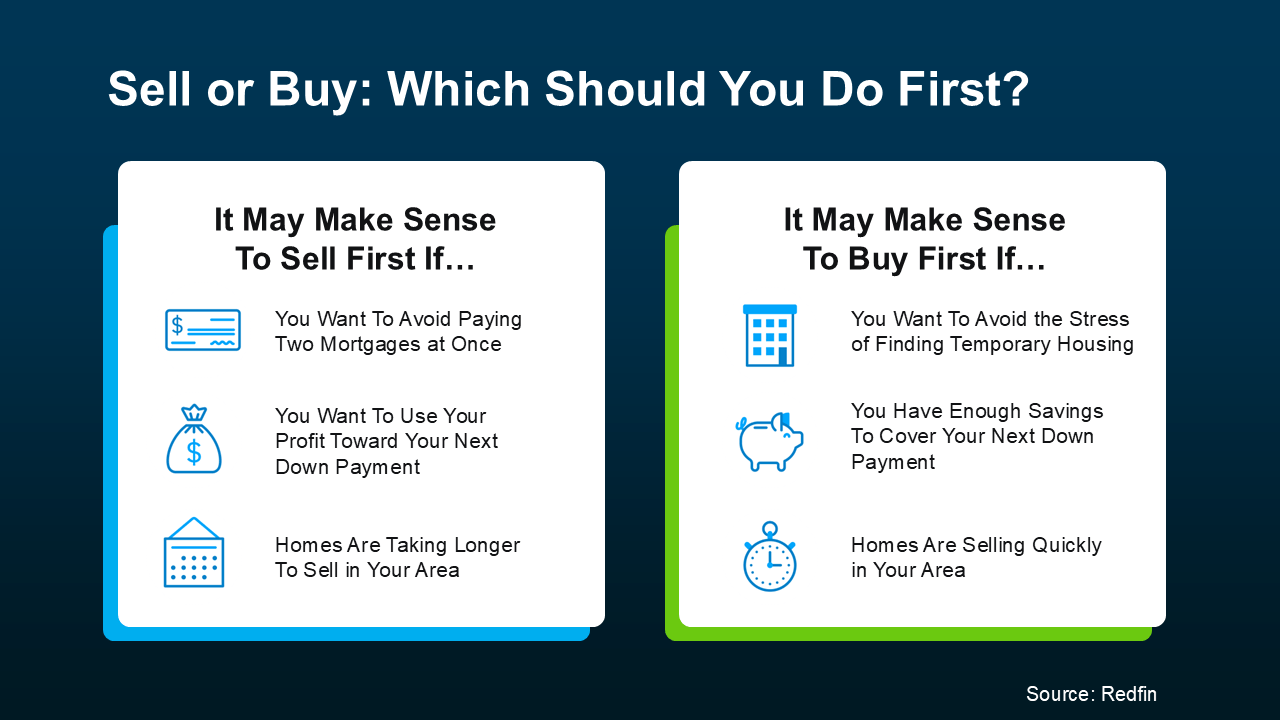

Selling and Buying at the Same Time? Here’s What You Need To Know

If you’re a homeowner planning to move, you’re probably wondering what the process is going to look like and what you should tackle first:

- Is it better to start by finding your next home?

- Or should you sell your current house before you go out looking?

Ultimately, what’s right for you depends on a lot of factors. And that’s where an agent’s experience can really help make your next step clear.

They know your local market, the latest trends, and what’s working for other homeowners right now. And they’ll be able to make a recommendation based on their expertise and your needs.

But here’s a little bit of a sneak peek. In many cases today, getting your current home on the market first can put you in a better spot. Here’s why that order tends to work best (and how an agent can help).

The Advantages of Selling First

1. You’ll Unlock Your Home Equity

Selling your current home before you try to buy your next one allows you to access the equity you’ve built up – and based on home price appreciation over the past few years, that’s no small number. Data from Cotality (formerly CoreLogic) shows the average homeowner is sitting on $302K in equity today.

And once you sell, you can use that equity to pay for the down payment on your next house (and maybe even more). You could even have enough to buy your next house in cash. That’s a big deal, and it could make your next move a whole lot easier on your wallet.

2. You Won’t Be Juggling Two Mortgages

Trying to buy before you sell means you could wind up holding two mortgages, even if just for a few months. That can get expensive, fast – especially if there are unexpected repairs or delays. Selling first removes that stress and helps you move forward without the financial strain. As Ramsey Solutions says:

“It’s best to sell your old home before buying a new one to avoid unnecessary risks and possible headaches.”

3. You’ll Be in a Stronger Position When You Make an Offer

Sellers love a clean, simple offer. If you’ve already sold your house, you don’t need to make your offer contingent on that sale – and that can help you stand out. Your agent can position your offer to be as strong as possible, so you have the best shot at getting the home you want.

This can be a big advantage in competitive markets where sellers prefer buyers with fewer strings attached.

One Thing To Keep in Mind

But, like with anything in life, there are tradeoffs. As you weigh your options, consider this potential drawback, too:

1. You May Need a Place To Stay (Temporarily)

Once your house sells, you may need a short-term rental or to stay with family until you can move into your next home. Your agent can help you negotiate things like a post-closing occupancy (renting the home from the buyer for a set period) or flexible closing dates to help smooth out that transition as much as possible.

Here’s a simple visual that can help you think through your options (see below):

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

Bottom Line

In many cases, selling first doesn’t just give you clarity, it gives you options. It helps you buy with more confidence, more financial power, and less pressure.

If you’re ready to make a move but you’re not sure where to begin, let’s talk. We can walk through your potential equity, your timing, and your local market conditions so you can decide what’s right for you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

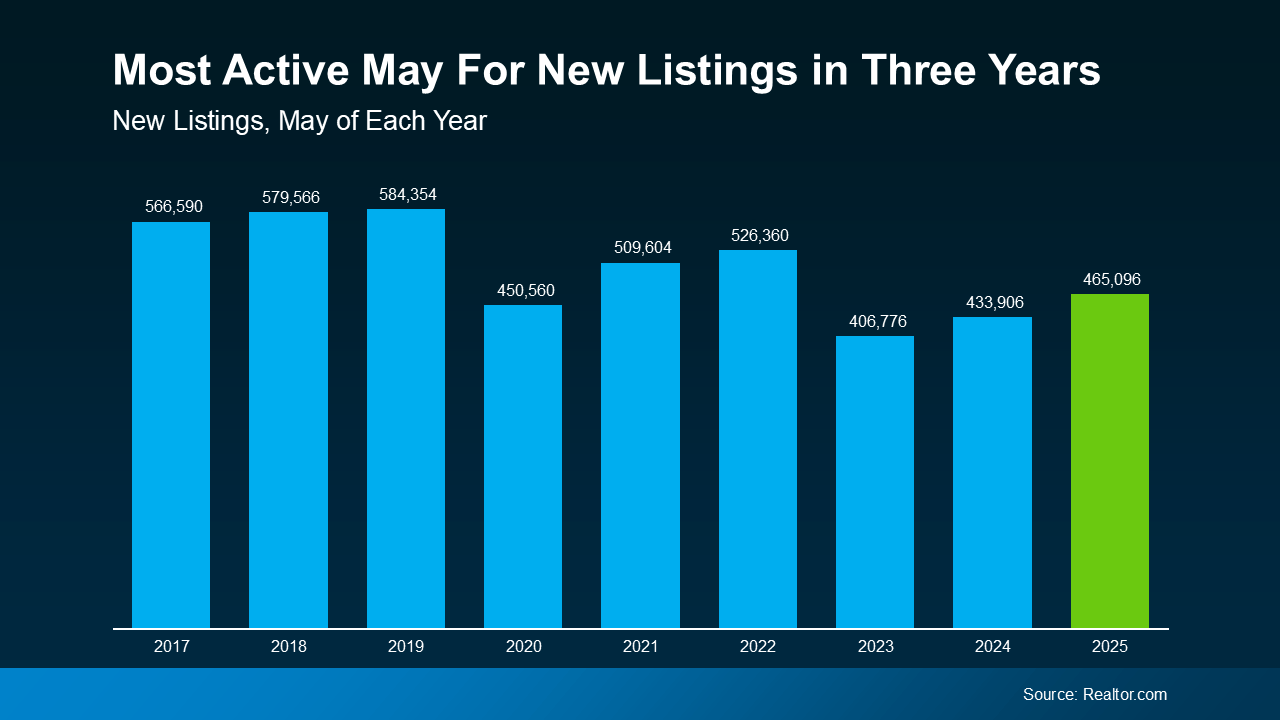

And more homes for sale means more choices. There’s a good chance your perfect match just hit the market – or it will soon. So, it’s a great time to explore what’s out there. As Jake Krimmel, Economist at Realtor.com, says:

And more homes for sale means more choices. There’s a good chance your perfect match just hit the market – or it will soon. So, it’s a great time to explore what’s out there. As Jake Krimmel, Economist at Realtor.com, says:

The takeaway? You may not need to save as much as you originally thought.

The takeaway? You may not need to save as much as you originally thought.